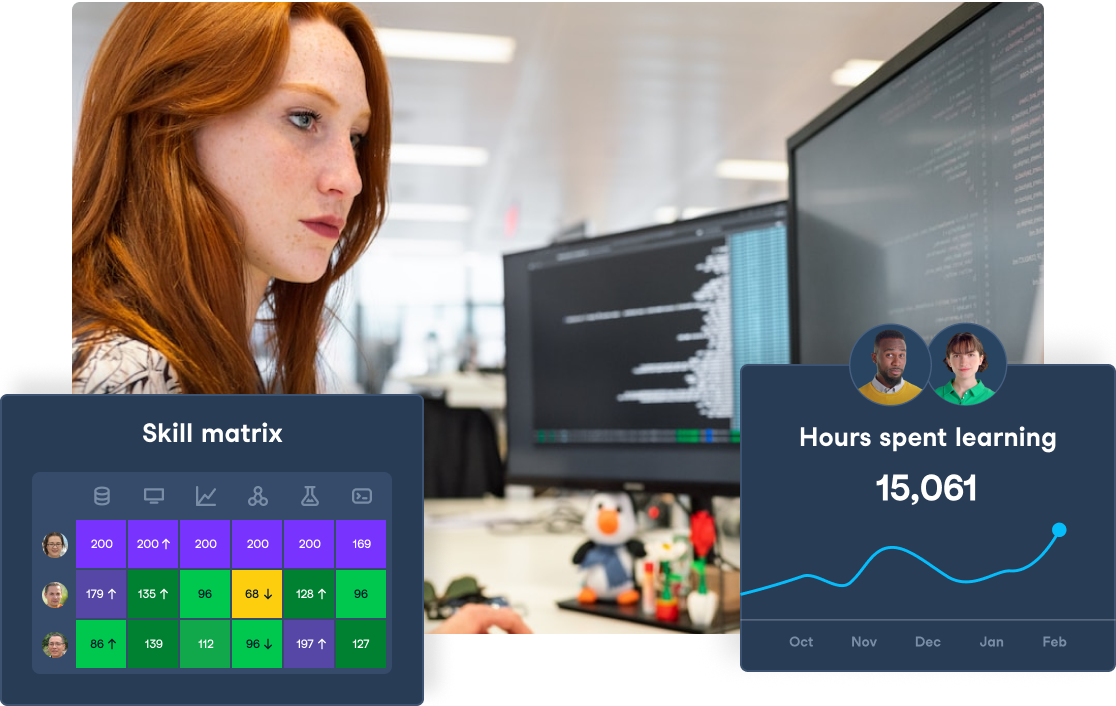

Elevate Your Finance Team's Data Skills

Train your finance team with DataCamp for Business. Comprehensive data and AI training resources and detailed performance insights to support your goals.

Artificial intelligence (AI) refers to the computer systems that can execute functions that typically require human intelligence, such as interpreting visual data, speech recognition, and also decision-making. In finance, AI technologies are being applied to improve various processes and uncover insights across banking, investing, insurance, and much more.

Volodymyr Shchegel, VP of Engineering at Clario

Another key application is the credit decisioning. AI tools can ingest diverse customer data like income and spending history to generate credit risk scores. These data-based scores are a lot more accurate and fair than the traditional methods.

Puneet Gogia, Founder at Excel Champs

However, while AI brings many benefits, the risks remain around bias, explainability, and ethical issues. Governance frameworks and also human oversight are still very necessary. The key is finding the right balance where AI systems enhance speed, accuracy, and efficiency while humans provide guidance around business priorities, risk appetite, and ethics. Together, they offer the best of both worlds.

Jim Pendergast, Senior Vice President at altLINE Sobanco

On the customer experience front, AI chatbots and virtual assistants enable 24/7 customer service at a fraction of the cost of the human agents. These bots can understand natural language, access customer data, and answer many common inquiries. However, more complex issues are smoothly handed over to the human representatives.

Robert Kaskel, Chief People Officer at Checkr

A key hurdle is acquiring clean, representative data to train AI models. As models are only as good as the data used to develop them, financial institutions must implement many robust data governance processes. However, many banks have a complex, fragmented data architecture spanning decades-old mainframe systems.

Connecting and preparing these data for AI projects requires a substantial effort. Firms must also ensure that sensitive customer data is properly anonymized and also protected.

Max Wesman, Founder & COO of GoodHire

Managing regulatory expectations around AI also poses many challenges. Laws and ethical expectations around AI are rapidly evolving. Continually monitoring regulatory developments across the jurisdictions and maintaining flexible systems is very critical but difficult. With careful project scoping and governance, financial institutions can overcome these hurdles.

Javier Muniz, CTO at LLC Attorney

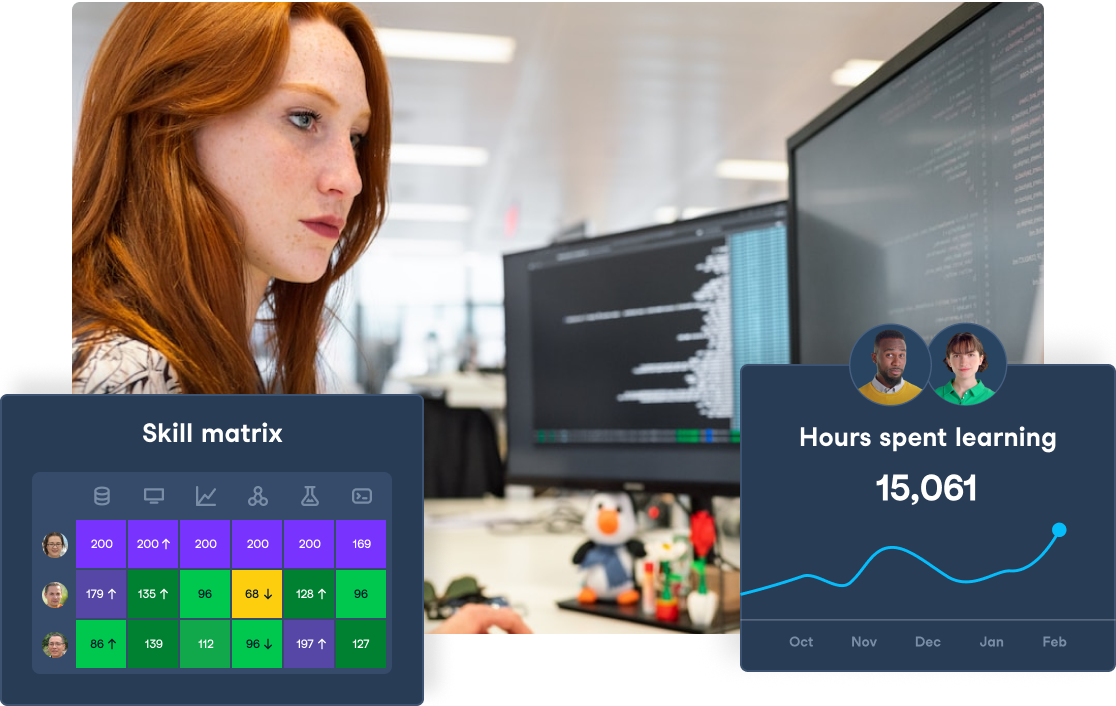

Elevate Your Organization's AI Skills

Transform your business by empowering your teams with advanced AI skills through DataCamp for Business. Achieve better insights and efficiency.