Financial analysts work in heavily quantitative and data-oriented roles. In a McKinsey survey, 87% of respondents said they were either currently facing or would be facing skill gaps within the next 5 years with 43% of them saying the largest gaps would be in data roles. These roles are increasingly important in Finance as Gartner predicts over 80% of financial service organizations will increase their use of advanced analytics in 2021.

Finance teams should be learning “modern” data tools like R, Python, and SQL or business intelligence to gain previously hidden insights. In addition to generating valuable insights, allowing analysts to learn new data skills is very appealing to job seekers according to 64% of participants in a Robert Half survey.

In this article, we will look at 4 data science use cases financial analysts can start leveraging today to supplement their subject matter expertise.

Four ways Financial Analysts Can Start with Data Skills

Analyze Data Quickly and Communicate Insights

A key component of a Financial Analyst’s responsibilities is their ability to analyze and draw insights from financial data. In addition to their skills with Excel, they can make the analysis process more efficient and effective by leveraging tools like SQL alongside BI tools and open source programming languages like R and Python.

These tools are especially useful in analyses involving larger datasets. SQL is a programming language used to communicate with databases to retrieve and organize data. It allows analysts to retrieve just the information they are interested in, leading to faster analysis workflows. For example, if an analyst was building a model to project cash flows for a specific department, they could filter the database, with all the organization's cash flows, for just the department they would like to analyze. Quickly accessing just the data needed for analysis will lead to significantly more efficient workflows.

Once the data are collected, insights can be quickly made through SQL by calculating summary statistics. For example, the average and standard deviation of cash flows in each month can be calculated quickly using grouped calculations in SQL.

Communicating insights from analyses to stakeholders is a critical component of adding value. Discovering how to improve cash flows is valuable only if effectively communicated to decision-makers in a way that causes them to take action. These insights can be accurately described through BI tools (such as Power BI and Tableau) or open-source libraries in Python and R such as Dash and Shiny. These tools allow analysts to quickly display their findings through interactive dashboards.

Make Better Decisions by Forecasting Time Series Data

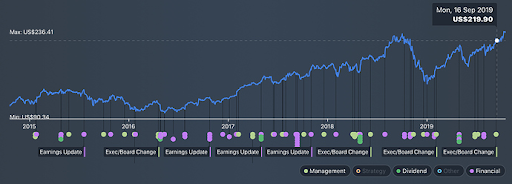

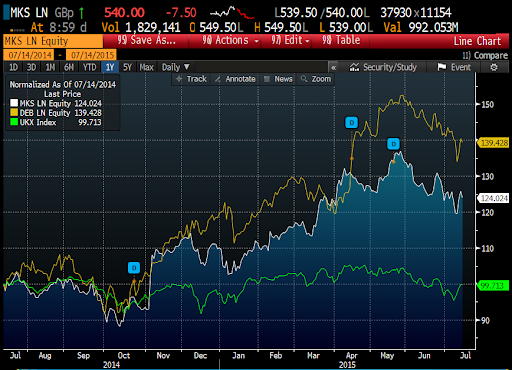

Another valuable use case in data science for financial analysts is analyzing time series data. Making accurate predictions is a common task for financial analysts. They can predict future stock price movement, customer churn, cash flows, or customer lifetime value. These predictions need to be reliable and accurate to add value to decision-making processes.

Historical data can be leveraged in prediction tasks to make more realistic and confident predictions. Seasonality is critical in many forecasting tasks. During the year, business activities fluctuate. This is especially true when disrupting events like covid-19 affected most organizations’ operations. Understanding these seasonal fluctuations can lead to significantly better predictions. There are many open-source tools in R and Python which streamline time-series analysis. These allow for a more dynamic approach to prediction tasks.

Automate Business Processes with Programming Skills

A valuable application of programming skills in any field is the ability to automate repeated tasks. Scripts in R or Python can run repeated tasks every day to save analysts time and allow them to work on other responsibilities.

One repeated task is an analyst putting together a list of the best-performing stocks for a given industry from the previous day. An analyst can create a script to run every night after the markets close. This script may scrape the necessary data by accessing the organization’s data api, use python data types and tools such as pandas DataFrames and a Jupyter notebook to effectively clean this data (for easier and more use), and finally generate an excel spreadsheet file in the format that the analyst always inputted the data manually in the past.

The next morning, the analyst can begin working on the subsequent tasks, such as writing a report about this data. Over a few weeks, the amount of work this analyst can complete because they don't have to make this spreadsheet manually every morning will be significant.

Predict Outcomes with Machine Learning

Machine learning plays an integral role in financial analysis. Supervised and unsupervised learning both can be leveraged in finance to improve the efficiency and effectiveness of tasks like document analysis and digitization of physical documents.

There are many applications of supervised learning (training machine learning models with “correct” labels to perform the task without given labels in the future) that can be used for financial tasks. Some of these tasks include converting physical documents into digital documents, fraud detection, optimal portfolio management, and future stock price predictions. All of these tasks are very important for financial analysts to perform accurately. Analysts can leverage machine learning with the large amounts of data available to them to more effectively complete these tasks. Other applications of machine learning in finance can be found here.

Unsupervised learning (training models without any predefined “correct” labels) can also be leveraged in these types of tasks also. One model that can be built may organize newly digitized documents in an appropriate file structure for easy access.

By building these models to handle basic document processing and analysis tasks, an analyst can spend more time working on creating actionable insights from all of this available data that is typically underutilized because of its inaccessibility.

Upskilling is the Only Way Moving Forward

As data science is integrated more into the financial industry, the only way for financial analysts to continue to be successful and fully produce their potential value to their organizations is to acquire data skills. As seen in the previous four use-cases, data science skills can greatly improve productivity and quality of work through automation, organization, and data visualizations.

A recent survey showed that 90% of financial firms expect to increase their data consumption within the next year and 52% of them believe meaningfully analyzing this data is a top strategic priority. Given the data talent skills gap, the only way to succeed with these expectations is for financial analysts to upskill.