Course

The compound annual growth rate (CAGR) is one of the most valuable metrics for analyzing performance over time. Understanding the CAGR formula in Excel can significantly enhance your analytical capabilities for common use cases such as investment returns, assessing business growth, or forecasting future trends.

This comprehensive guide will walk you through everything from basic calculations to advanced techniques, ensuring you can confidently apply CAGR analysis to your professional work. For something even more more comprehensive, enroll in our Financial Modeling in Excel course.

What Is the CAGR Formula?

Compound annual growth rate represents the mean annual growth rate of an investment or business metric over a specified time period longer than one year.

Unlike simple growth rates that can fluctuate dramatically from year to year, CAGR provides a smoothed rate that accounts for compounding effects, offering a clearer picture of steady growth over time.

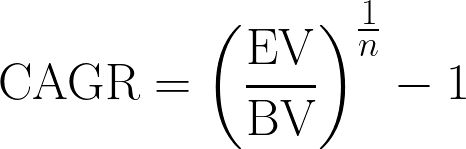

The mathematical formula for CAGR is:

CAGR equation. Image by Author

Where:

- EV (ending value) is the final value of your asset or metric

- BV (beginning value) is the initial value

- n is the number of years in the period

Now that we’ve understood the equation, let’s dive into the Excel calculations using an example.

How to Calculate CAGR in Excel

Before using the CAGR formula in Excel, it's essential to organize your data correctly. Let’s start by setting up an effective spreadsheet structure to be the foundation for all our CAGR analyses.

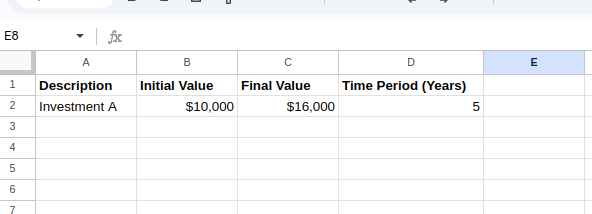

Setting up the data

Create three essential columns: Initial Value, Final Value, and Time Period (Years). In our example, these are columns B, C, and D. Don’t forget to format the cells appropriately. Typically, you’ll want to format the values as currency or numbers, and the time period as a number.

In Excel, it will look like this:

Setting up the data. Image by Author.

Setting up the data. Image by Author.

Now that we have our data organized, let’s explore the different methods of calculating CAGR in Excel.

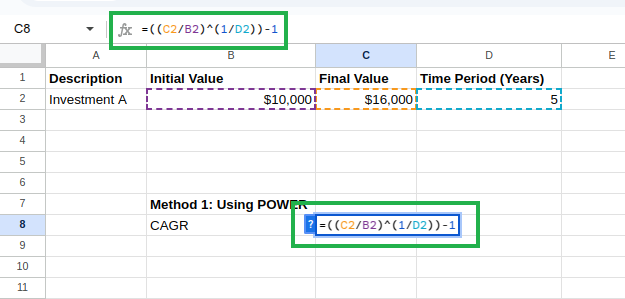

Method 1: Using the POWER() function

The most straightforward approach uses Excel’s power function. The POWER() function in Excel calculates the result of a number raised to a specified power. In Excel, you can also use the caret symbol (^) as an alternative to the POWER() function.

In our example, say on cell C8, type the following equation:

=((B3/B2)^(1/B4))-1 Calculating CAGR using POWER() function. Image by Author.

Calculating CAGR using POWER() function. Image by Author.

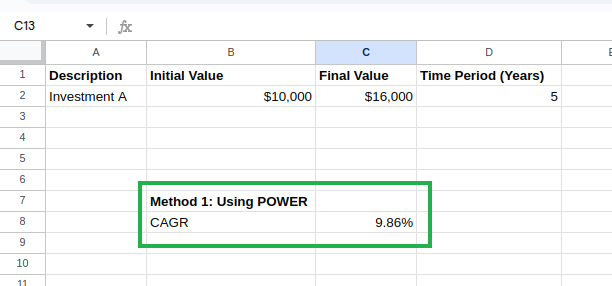

You should see the result:

Calculated CAGR. Image by Author.

Calculated CAGR. Image by Author.

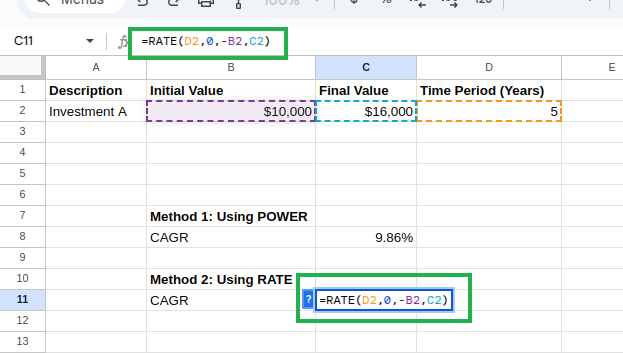

Method 2: Using the RATE() function

We could also use Excel’s RATE function instead. The RATE() function calculates the interest rate per period for a loan or investment. We can adapt it for CAGR as follows:

=RATE(D2,0,-B2,C2)where:

-

D2is the number of periods (years) -

The second parameter (periodic payment) is set to

0 -

-B2is the negative of the initial value (required for theRATE()function) -

C2is the final value

Calculating CAGR using RATE() function. Image by Author.

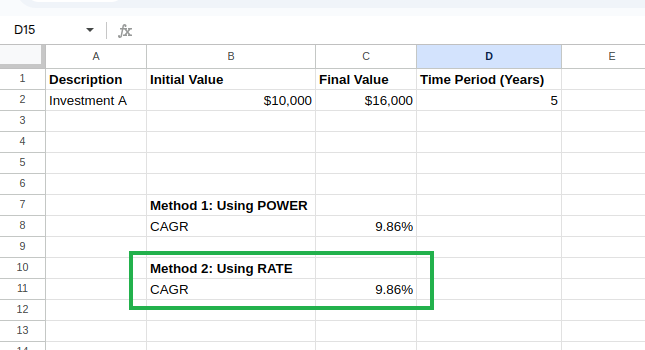

We’ll be seeing the same value as above:

Calculated CAGR. Image by Author.

Calculated CAGR. Image by Author.

Now that we have covered the basics, let’s explore more advanced techniques for calculating CAGR in Excel.

More Advanced Excel CAGR Techniques

While the basic CAGR example we saw above works well for standard situations, we sometimes encounter different scenarios in the real world. Let’s explore some advanced techniques to handle these scenarios.

Handling irregular time periods

What if your data is irregular, with investments starting mid-year or sales figures spanning unusual time frames?

Imagine you’re analyzing a product launch that began in March 2023 and has performance data through September 2024. Using a standard CAGR calculation with “2 years” would be inaccurate.

In cases like these, leveraging Excel’s date functions becomes essential. One effective method is using the YEARFRAC() function to compute the exact fraction of the year between the start and end dates.

=(EV/BV)^(1/YEARFRAC(start_date, end_date))-1This approach calculates the exact time period as a fraction of a year, ensuring that the growth rate reflects the true duration of the investment. Alternatively, for scenarios where a more detailed breakdown is needed, the DATEDIF() function can be used to determine the number of months or days, which can then be incorporated into the CAGR formula for added precision.

Incorporating additional variables

Beyond irregular time periods, real-world CAGR calculations may require adjustments for external factors or additional cash flows. Here are some advanced techniques that incorporate additional variables into the analysis:

Inflation-adjusted CAGR

Inflation can erode the real value of returns. Adjusting the CAGR to account for inflation yields a more realistic view of growth. The formula is modified as follows:

=((EV/BV)^(1/n)-1) - InflationRateCAGR with irregular cash flows

When cash flows are not uniform, due to additional investments or withdrawals, the standard CAGR formula may not capture the true growth. In these cases, the XIRR() function is ideal because it accounts for the exact dates of each cash flow:

=XIRR(cash_flows, dates)Weighted CAGR

Sometimes, different periods contribute unequally to overall performance. By applying a weighted approach, you can assign more significance to periods with higher investments or returns. While Excel does not have a built-in weighted CAGR function, combining functions like SUMPRODUCT() and SUM() allows for a custom calculation.

=SUMPRODUCT(Values, Weights)/SUM(Weights)This method aggregates the performance metrics while considering the weight of each period. By incorporating these equations and techniques, your Excel CAGR calculations become more robust and adaptable to real-world scenarios.

Practical Applications of the Excel CAGR Formula

CAGR is a widely used calculation across multiple domains. It provides valuable insights into growth patterns and performance over time and can be applied in various fields, including:

- Investment analysis: CAGR enables investors to evaluate and compare the performance of different investments over varying time periods. Smoothing out volatility helps determine which assets have delivered the most consistent returns regardless of short-term fluctuations, allowing for more informed portfolio allocation decisions.

- Business growth planning: Companies use CAGR to analyze historical growth trends and establish realistic future targets. By calculating the CAGR of key metrics like revenue, profit margins, or customer acquisition, businesses can set achievable goals and develop strategic plans that align with their historical performance trajectory.

- Market research: Analysts use CAGR to assess market growth rates and identify emerging opportunities. When examining industry trends or specific product segments, CAGR helps quantify growth momentum and compare performance across different market sectors, revealing which areas are experiencing accelerated development.

- Sales performance evaluation: Sales teams utilize CAGR to measure the effectiveness of long-term sales strategies. Rather than focusing on quarter-to-quarter fluctuations, CAGR analysis helps identify consistent growth patterns and evaluate the impact of strategic initiatives implemented over multiple years.

- Economic analysis: Economists apply CAGR when analyzing macroeconomic indicators like GDP, employment rates, or housing prices. Examining compounded growth over extended periods provides insight into sustainable growth rates and helps identify potential economic cycles.

CAGR’s ability to normalize growth rates across different time periods makes it particularly valuable for comparative analysis and long-term planning.

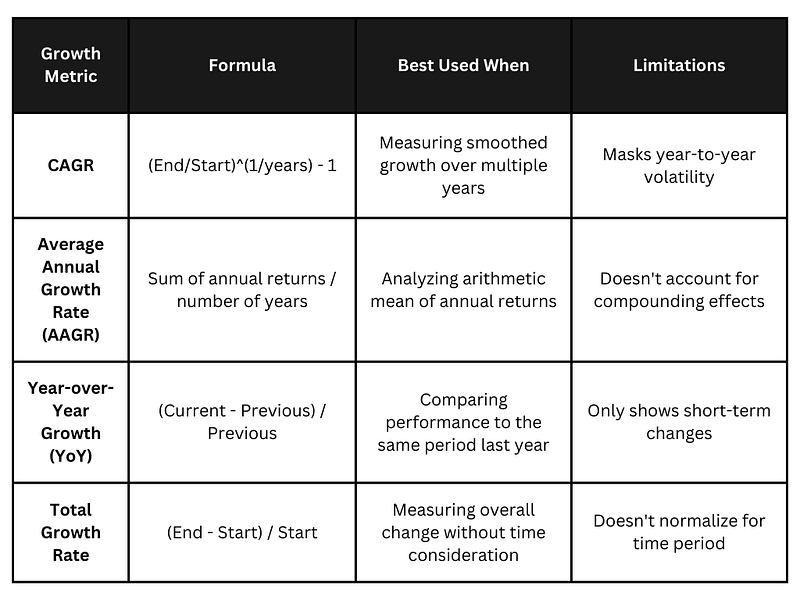

Excel CAGR Formula vs. Other Growth Rate Calculations

While CAGR is an extremely useful metric, it’s essential to understand how it compares to other growth measurements and when each is most appropriate.

We shall compare CAGR with other standard metrics, such as the average annual growth rate (AAGR), year-over-tear growth (YoY), and total growth rate.

Comparing CAGR with other growth rates. Image by Author.

Comparing CAGR with other growth rates. Image by Author.

As seen in the table above, CAGR’s main advantage is its ability to smooth out volatility and provide a “steady growth rate” equivalent.

However, this same feature can sometimes mask critical year-to-year fluctuations. For instance, a business that experienced explosive growth followed by a plateau would show a moderate CAGR that fails to highlight this pattern. In such cases, supplementing CAGR with year-by-year growth rates provides a more complete picture.

Similarly, while AAGR is more straightforward to calculate, it typically overestimates growth compared to CAGR because it doesn’t account for the compound effect. CAGR is often the preferred metric for long-term forecasting.

Conclusion

This article introduced you to the Excel CAGR formula and its practical applications. We discussed multiple methods for calculating CAGR in Excel, such as using the POWER() and RATE() functions. We also learned how to handle irregular time periods and incorporate additional variables for more complex scenarios.

Understanding how to implement and interpret CAGR calculations in Excel correctly will significantly enhance your analytical capabilities. The concepts and techniques covered in this guide provide a solid foundation for applying CAGR in your professional work.

To further develop your Excel financial modeling skills, consider exploring our Financial Modeling in Excel course, which builds upon these concepts with more advanced applications. For a broader skill set, our Data Analysis with Excel Power Tools skill track offers comprehensive training in Excel’s most powerful analytical features.

Master Excel with DataCamp for Business

Equip your team with top-tier Excel skills through DataCamp for Business. Comprehensive training and performance tracking for business success.

As a senior data scientist, I design, develop, and deploy large-scale machine-learning solutions to help businesses make better data-driven decisions. As a data science writer, I share learnings, career advice, and in-depth hands-on tutorials.

What is CAGR?

What is CAGR?

CAGR calculates the compound annual growth rate, providing a smoothed annual rate of growth over a specified time period.

How do you calculate CAGR in Excel?

To calculate CAGR in Excel, use the formula: CAGR = (Ending Value/Beginning Value)^(1/Number of Years) - 1

What is the difference between CAGR and simple annual growth rate?

CAGR accounts for the compounding effect over multiple years, providing a smoothed growth rate representing steady year-over-year growth. A simple annual growth rate only measures the percentage change between two points without accounting for compounding.

Why is my CAGR calculation showing #NUM! error in Excel?

This error typically occurs when your ending value is negative or when your starting value is zero. CAGR calculations require a positive starting value and either a positive or zero ending value.

When should I use XIRR instead of the standard CAGR formula?

Use XIRR instead of standard CAGR when you have irregular cash flows or investments made at different time intervals.