Course

Financial analysts play a vital role in shaping business strategy and driving key decisions through their insights and analysis. Their work spans from evaluating market opportunities to forecasting financial performance, directly influencing how companies invest, grow, and compete in the marketplace. As the financial industry becomes more complex, analysts must blend traditional financial expertise with advanced analytical capabilities to deliver meaningful insights to stakeholders.

This guide explores interview questions across different levels and specializations, preparing you for roles ranging from entry-level positions to specialized functions in corporate finance and investment banking. And if you are reading this guide because you are interviewing in the space, consider reaching out to DataCamp for Business to help equip your team with even more advanced analytical skills.

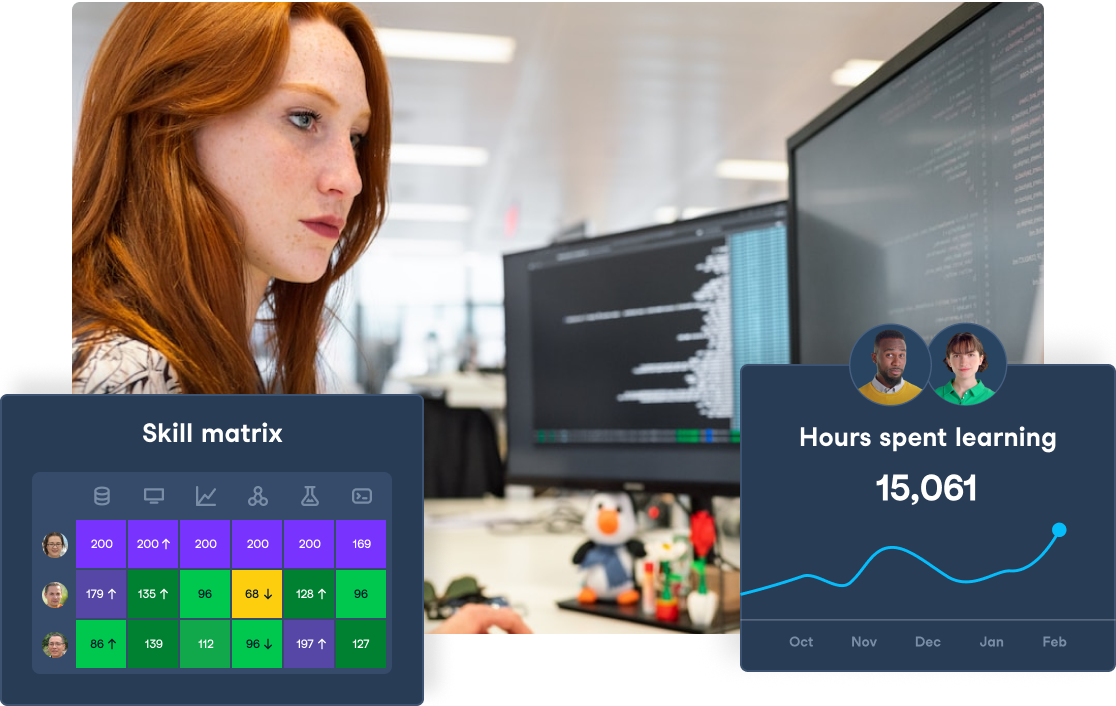

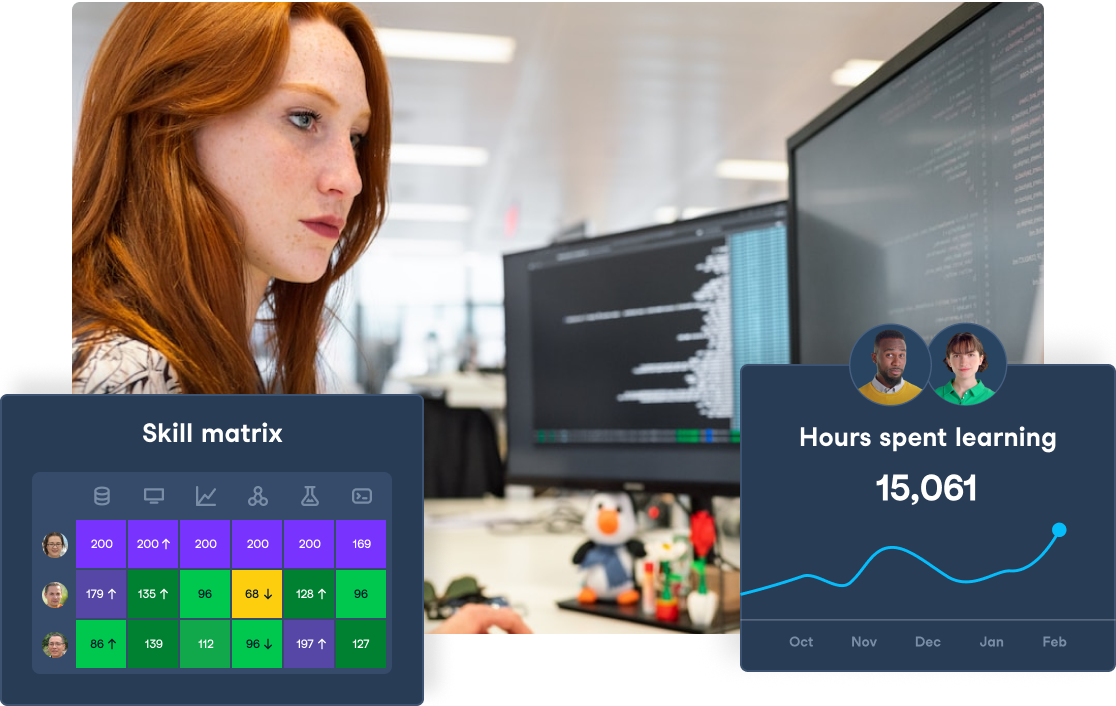

Elevate Your Finance Team's Data Skills

Train your finance team with DataCamp for Business. Comprehensive data and AI training resources and detailed performance insights to support your goals.

Basic Financial Analyst Interview Questions

Financial analysts at the entry-level need to demonstrate strong foundational knowledge of financial statements, basic ratios, and market understanding. These questions test your grasp of essential financial concepts that you'll use daily.

1. What are the three main financial statements, and how are they connected?

The three main financial statements are the Income Statement, Balance Sheet, and Cash Flow Statement. Each plays a crucial role in telling a company's financial story:

- The Income Statement shows profitability over a period, tracking revenues, costs, and expenses

- The Balance Sheet provides a snapshot of assets, liabilities, and equity at a specific point in time

- The Cash Flow Statement tracks actual cash movements across operating, investing, and financing activities

These statements are interconnected: Net income from the Income Statement affects retained earnings on the Balance Sheet. Meanwhile, non-cash items from the Income Statement are reconciled in the Cash Flow Statement, and changes in Balance Sheet accounts help construct the Cash Flow Statement.

2. How would you evaluate a company's financial health using financial ratios?

When evaluating a company's financial health, I focus on four key areas:

- Liquidity ratios (like Current Ratio and Quick Ratio) to assess short-term solvency

- Profitability ratios (such as Gross Margin and Net Profit Margin) to evaluate earnings efficiency

- Solvency ratios (like Debt-to-Equity) to examine long-term financial stability

- Efficiency ratios (such as Asset Turnover) to measure operational performance

However, these ratios should be analyzed in context - comparing them to industry averages, historical performance, and considering the company's growth stage and business model.

3. What are the key market and economic indicators you monitor as a financial analyst?

When analyzing companies and markets, I focus on both broad economic indicators and sector-specific metrics. At the macro level, I track GDP growth, inflation rates (CPI and PPI), interest rates, and employment data, as these fundamentals directly impact consumer spending, borrowing costs, and overall business conditions. The Federal Funds Rate and Treasury yields are particularly important as they influence everything from corporate borrowing costs to equity valuations.

For deeper insights, I monitor industry-specific indicators that directly affect company performance. For retail, this means consumer confidence and retail sales data; for manufacturing, the PMI and industrial production numbers. I also track market sentiment through the VIX index and credit spreads, while keeping an eye on currency exchange rates for companies with international operations. These metrics together provide a comprehensive framework for understanding both opportunities and risks in the market.

4. Walk me through how you would build a simple financial model to forecast revenue.

Building a revenue forecast model starts with a thorough historical analysis. I typically gather 2-3 years of historical revenue data to identify underlying trends, seasonal patterns, and year-over-year growth rates. This historical perspective provides a foundation for understanding the company's growth trajectory and cyclical patterns.

Next, I identify key revenue drivers specific to the business model. For an e-commerce company, this might include metrics like active customers, average order value, and purchase frequency. For a subscription business, I'd focus on subscriber count, monthly recurring revenue, and churn rates. The key is understanding which factors truly drive revenue growth and how they interact.

Then comes the forecasting phase, where I develop growth assumptions based on historical performance, market conditions, and company-specific factors. For example, if a company is expanding into new markets, I'd model different growth rates for existing and new territories. Throughout this process, I document all assumptions clearly and include sensitivity analyses for key variables. This makes the model both transparent and adaptable to changing conditions.

To deepen your understanding of these concepts, consider exploring DataCamp's Financial Analytics in Google Sheets course to master financial modeling basics, or Finance Fundamentals in Python to learn how to analyze financial data programmatically.

Intermediate Financial Analyst Interview Questions

At the intermediate level, financial analysts are expected to handle more complex analyses, create detailed forecasts, and demonstrate proficiency with financial software and databases. These questions assess your ability to apply advanced financial concepts and leverage technical tools effectively.

5. How do you use SQL and financial databases to enhance your financial analysis?

Modern financial analysis relies heavily on efficiently handling large datasets, and SQL has become an essential tool in my analytical toolkit. I use SQL primarily for two key purposes: data extraction and analysis automation. When working with large financial databases, I write SQL queries to pull exactly the data I need, often combining information from multiple sources. For example, I might join transaction data with customer information to analyze revenue patterns across different customer segments or geographic regions.

The real power of SQL comes in creating repeatable analysis workflows. I develop stored procedures for regular reporting needs and create custom views for frequently accessed data combinations. For instance, to analyze customer profitability, I might create a view that automatically calculates key metrics like customer lifetime value, acquisition costs, and retention rates. This not only saves time but also ensures consistency in how metrics are calculated across different analyses. The key is writing clean, well-documented queries that others can understand and modify as business needs evolve.

6. What methods do you use to identify and account for potential biases in financial forecasts?

Addressing forecast bias requires both systematic analysis and a good understanding of human behavior in financial modeling. The first step is always looking backward – I review previous forecasts against actual results to identify patterns of over- or under-estimation. This historical analysis often reveals systematic biases, such as being consistently too optimistic about growth rates or underestimating seasonal fluctuations.

To mitigate these biases, I employ several practical strategies. I always use multiple forecasting methods, combining both top-down and bottom-up approaches to cross-validate results. For example, while forecasting revenue, I might compare industry growth rates and market share analysis (top-down) with detailed customer segment projections (bottom-up). I also incorporate probability-weighted scenarios and conduct peer reviews of key assumptions. Regular forecast reviews and feedback loops are crucial – when actuals deviate from forecasts, I document the reasons why and use these insights to improve future forecasting accuracy. The goal isn't perfect prediction but rather understanding and accounting for our inherent biases to produce more reliable forecasts.

7. How would you approach building a sensitivity analysis for a major capital investment decision?

A thorough sensitivity analysis for capital investment decisions starts with building a solid baseline case. I begin by creating a DCF model that incorporates all key assumptions about revenues, costs, initial investment, and timing. This baseline model calculates standard metrics like NPV, IRR, and payback period, providing a foundation for our sensitivity testing.

The real insight comes from systematically testing how changes in key variables affect project outcomes. I identify the most critical variables – typically things like revenue growth rates, margins, capital costs, and market size – and establish reasonable ranges for each based on industry experience and market conditions. The key is focusing on variables that have both high uncertainty and significant impact on results. For instance, in a manufacturing project, small changes in raw material costs might impact profitability more than variations in administrative expenses. I then create scenarios combining different variables to understand potential outcomes under various conditions. This helps stakeholders understand not just whether a project might be profitable but how robust that profitability is under different circumstances.

8. How do you approach analyzing and valuing companies in emerging markets?

Analyzing companies in emerging markets requires adapting traditional valuation approaches to account for unique challenges and risks. The first challenge is data quality and availability. When faced with limited financial data, I focus on triangulating information from multiple sources – company reports, industry data, competitor analysis, and local market expertise. It's helpful to understand local accounting standards and how they differ from international standards like IFRS or GAAP.

The valuation process itself needs several key adjustments. I typically apply higher discount rates to account for additional country risk, currency risk, and governance concerns. When using comparable company analysis, I look beyond local peers to include similar companies in more developed markets while adjusting for market differences. Political risk, regulatory changes, and currency volatility need special consideration in the analysis. The key is being transparent about assumptions and limitations while providing a range of values rather than a single-point estimate. This helps stakeholders understand both the opportunities and the risks inherent in emerging market investments.

To further develop your skills in these areas, explore DataCamp's Financial Analysis in Power BI course to enhance your data analysis capabilities and Introduction to Python for Finance to learn how to automate complex financial calculations and analyses.

Advanced Financial Analyst Interview Questions

At the advanced level, financial analysts need to demonstrate expertise in complex strategic planning, M&A analysis, and sophisticated risk management. These questions assess your ability to handle high-stakes financial decisions and provide strategic advisory insights.

9. Walk me through how you would value a company for a potential acquisition.

A comprehensive acquisition valuation requires multiple approaches to arrive at a well-supported value range. I start with Discounted Cash Flow (DCF) analysis as the foundation, projecting future cash flows and determining an appropriate discount rate that reflects the company's risk profile. The challenge here isn't just in the mechanics but in developing realistic growth assumptions and understanding how the business might evolve under new ownership.

Next, I analyze comparable companies and recent transactions in the industry to provide market-based perspectives. This means looking at trading multiples like EV/EBITDA and P/E ratios but going deeper than just the numbers. Understanding why certain companies trade at premium multiples while others don't help inform where our target should fall in the range. I also consider deal-specific factors that could affect value, such as potential synergies, integration costs, working capital needs, and any restructuring required. The final valuation typically presents a range based on these different approaches, weighted according to their relevance and reliability for this specific situation.

10. How do you approach currency risk management in a corporation operating in volatile markets?

Managing currency risk in multinational operations requires understanding and addressing three distinct types of exposure. Transaction exposure affects immediate cash flows, like when a company sells products in one currency but incurs costs in another. Translation exposure impacts financial statements when converting foreign subsidiary results to the parent company's reporting currency. Economic exposure represents the long-term impact of currency movements on company value and competitive position.

Each type of exposure requires different management strategies. For transaction exposure, I typically recommend a combination of natural hedging (matching currency flows) and financial hedging using instruments like forwards or options. The key is finding the right balance – over-hedging can be as costly as under-hedging. For translation and economic exposure, the focus shifts to more strategic solutions like diversifying operations across currencies, adjusting pricing strategies, or localizing supply chains. The goal isn't to eliminate all currency risk but rather to manage it cost-effectively while maintaining operational flexibility. It's crucial to understand which exposures materially impact the business and focus hedging efforts there.

11. How would you evaluate the success of a post-merger integration?

Evaluating post-merger integration success requires monitoring both quantitative and qualitative metrics across multiple timeframes. In the short term, I focus on operational continuity metrics: customer retention rates, employee turnover, supply chain disruptions, and system integration milestones. These early indicators help identify potential integration issues before they become significant problems.

On the financial side, I track progress against the original deal thesis, particularly synergy realization. This includes cost synergies like overhead reduction and operational efficiencies, as well as revenue synergies from cross-selling opportunities and market expansion. However, numbers alone don't tell the full story. Cultural integration often determines long-term success, so I also monitor employee satisfaction, retention of key talent, and adoption of shared processes and values. The key is establishing clear baselines pre-merger and having realistic timelines for the achievement of different integration goals.

12. Explain your approach to analyzing and valuing intangible assets.

Valuing intangible assets requires a sophisticated approach, particularly in knowledge-intensive industries like technology and pharmaceuticals, where traditional tangible asset metrics may be less relevant. For technology companies, I focus on assets like intellectual property, customer relationships, brand value, and network effects. The key is understanding how these intangibles create competitive advantages and drive future cash flows. For example, when valuing a software company's customer relationships, I analyze metrics like customer lifetime value, churn rates, and customer acquisition costs.

In pharmaceutical companies, the focus shifts to R&D pipelines and patent portfolios. This involves assessing the probability of successful drug development, potential market size, and the strength of patent protection. I typically use risk-adjusted NPV models that account for different development stages and success rates. Other considerations include regulatory approval timelines, competitive landscape, and potential market adoption rates. The goal is to quantify how these intangible assets contribute to the company's overall value creation potential while acknowledging the inherent uncertainty in their valuation.

To enhance your expertise in these advanced topics, consider exploring DataCamp's Applied Finance in Python track for complex financial modeling and Analyzing Financial Statements in Python to master advanced analytical techniques for strategic decision-making.

Financial Analyst Interview Questions for Corporate Finance Roles

Corporate finance analysts need to excel at internal financial management, focusing on optimizing capital structure, evaluating investments, and maintaining robust financial controls. These questions assess your ability to make strategic internal financial decisions that drive company growth and efficiency.

13. How would you evaluate competing capital investment projects when there are limited resources?

Evaluating competing capital investment projects with limited resources requires both rigorous quantitative analysis and strategic thinking. The first step is calculating standard financial metrics like NPV, IRR, and payback period for each project. However, the real insight comes from risk-adjusted returns analysis - adjusting expected returns based on each project's specific risks and uncertainties. For example, a project with stable cash flows might be preferred over one with higher potential returns but greater uncertainty.

Beyond the numbers, strategic fit is crucial. I evaluate how each project aligns with company strategy, contributes to competitive advantage, and impacts operational capabilities. Resource constraints also extend beyond just capital - we need to consider human capital requirements, technology needs, and organizational impact. Sometimes, a smaller project that can be executed well is better than a larger one that stretches resources too thin. The final recommendation needs to balance financial returns with strategic benefits while ensuring the selected projects can be implemented effectively with available resources.

14. How do you establish and monitor effective internal controls for financial reporting?

Effective internal controls for financial reporting start with a robust control framework that balances security with operational efficiency. At its core are fundamental principles like segregation of duties and clear authorization hierarchies. For example, the person who approves payments shouldn't be the same person who reconciles bank statements, and system access should be granted based on specific job requirements. This creates natural checks and balances while maintaining operational efficiency.

The monitoring aspect is equally important and requires a combination of preventive and detective controls. I implement regular reconciliation processes, exception reporting mechanisms, and clear audit trails for all significant transactions. But controls are only as good as their execution, so regular training and clear documentation are essential. I also focus on continuous improvement - regularly assessing control effectiveness, identifying automation opportunities, and adapting controls as business processes evolve. The goal is to prevent errors and fraud while ensuring financial reporting remains reliable and efficient.

15. Explain your approach to optimizing a company's capital structure. How would you determine the mix of debt and equity?

Optimizing capital structure is about finding the right balance between debt and equity that minimizes the company's cost of capital while maintaining financial flexibility. I start by analyzing the company's current weighted average cost of capital (WACC), examining both the cost of existing debt and equity. Then, I consider how different funding mixes might affect these costs. More debt typically lowers WACC due to tax benefits, but too much debt increases financial risk and can actually raise both debt and equity costs.

The optimal structure depends heavily on company-specific factors. I look at cash flow stability, growth opportunities, and asset base – companies with stable cash flows and tangible assets can generally support more debt than those with volatile earnings or primarily intangible assets. Industry dynamics also matter; I analyze peer capital structures and industry norms. The key is maintaining flexibility for future opportunities while maximizing tax benefits and maintaining an appropriate credit profile. This often means targeting a range rather than a specific debt-to-equity ratio, allowing for adjustment as market conditions and company needs evolve.

16. How do you evaluate and recommend hedging strategies for managing various types of financial risk?

Developing effective hedging strategies requires first identifying and quantifying the specific risks facing the company. I typically categorize risks into market risks (including interest rate, currency, and commodity price risk), credit risk, and liquidity risk. The key is understanding not just the risks themselves but how they interact and impact the company's overall risk profile. For example, a manufacturer might face both commodity price risk in raw materials and currency risk from international sales.

Rather than trying to eliminate all risks, I focus on managing those that could materially impact financial performance. The choice of hedging instruments depends on factors like cost, complexity, and effectiveness. Natural hedges, like matching currency flows or adjusting pricing strategies, are often the most cost-effective starting point. Financial instruments like forwards, futures, or options can then be used to address remaining exposures. The goal is to create a balanced hedging program that protects against significant risks while remaining cost-effective and operationally manageable. Regular review and adjustment of hedging strategies ensures they remain aligned with the company's risk tolerance and business objectives.

To strengthen your corporate finance skills, explore DataCamp's Financial Modeling in Excel course to master advanced modeling techniques, and How Financial Analysts can start leveraging data skills to enhance your analytical capabilities with modern tools.

Financial Analyst Interview Questions for Investment Banking Roles

Investment banking analysts must combine technical valuation expertise with deal execution skills and client relationship management. These questions evaluate your ability to handle complex financial transactions while maintaining professional client interactions.

17. How do you prepare a pitch book for a potential client, and what do you include?

A successful pitch book tells a compelling story while demonstrating thorough analysis and clear understanding of the client's needs. I start by conducting detailed research on the client's business, industry position, and strategic challenges. The opening section typically presents our understanding of their situation and objectives – showing we've done our homework and understand what matters to them.

The core of the pitch book follows a logical progression: industry analysis, company positioning, strategic opportunities, and our specific recommendations. Each section needs to be both comprehensive and concise, supported by relevant data and analysis. For example, the industry section might include market sizing, growth trends, and competitive dynamics, while the strategic section could present specific M&A opportunities or capital-raising alternatives. Throughout the document, I focus on clear, actionable insights rather than just data dumps. Visual elements like charts and graphs are carefully chosen to support key messages. The goal is to demonstrate both our analytical capabilities and our understanding of the client's strategic objectives while presenting a clear path forward.

18. Walk me through a complex DCF analysis for a high-growth technology company.

When performing DCF analysis for high-growth tech companies, traditional approaches need significant adaptation to capture the unique characteristics of these businesses. I typically structure the forecast period into multiple stages: a high-growth phase (often 5-10 years), a transition period where growth moderates, and a terminal period. This extended forecast period is crucial because many tech companies prioritize growth over near-term profitability, making shorter forecast periods less meaningful.

Key adjustments are needed throughout the analysis. For example, stock-based compensation needs careful treatment - while it's a non-cash expense, it represents real economic cost and potential dilution. R&D costs often need to be capitalized to better reflect their investment nature. Customer acquisition costs and lifetime value metrics are crucial for understanding sustainable growth rates. When determining the discount rate, I typically apply higher rates to reflect the increased uncertainty and execution risk. The terminal value calculation is particularly challenging - you need to consider factors like platform sustainability, network effects, and potential technological disruption. The final valuation often includes scenario analysis to capture the wide range of potential outcomes typical in high-growth tech companies.

19. Walk me through how you would analyze a leveraged buyout (LBO) opportunity.

Analyzing an LBO opportunity requires careful consideration of three key elements: the company's ability to support debt, the potential for operational improvement, and viable exit strategies. I start by examining the target's cash flow stability and debt capacity. Strong, predictable cash flows are essential since they'll need to cover both debt service and provide adequate returns to equity investors. This means looking beyond just EBITDA to understand working capital requirements, maintenance capital expenditure needs, and potential cyclicality in the business.

The next focus is identifying opportunities to improve operations and grow value during the holding period. This could include cost-reduction initiatives, revenue growth opportunities, or strategic add-on acquisitions. I model different scenarios to understand potential returns under various cases - base, upside, and downside. Key metrics I track include IRR, cash-on-cash returns, and debt paydown capability. A successful LBO model needs realistic assumptions about leverage levels, interest rates, and exit multiples. The exit strategy is particularly crucial - whether through strategic sale, IPO, or secondary buyout - as it significantly impacts potential returns. Ultimately, the analysis should show whether target returns can be achieved with reasonable assumptions and manageable risk.

20. How do you structure an M&A deal to address buyer and seller concerns while maximizing transaction value?

Successful M&A deal structuring is about finding creative solutions that align the interests of both parties while managing risk. I start by understanding each party's key objectives and concerns. For buyers, this often means concerns about valuation certainty, integration risks, and potential liabilities. Sellers typically focus on maximizing value, tax efficiency, and in some cases, ongoing involvement in the business.

The art of deal structuring lies in using various mechanisms to bridge gaps between buyer and seller expectations. For example, earnouts can help bridge valuation gaps by linking part of the purchase price to future performance, though they need careful structuring to avoid future disputes. Working capital adjustments ensure fair treatment of short-term assets and liabilities, while representations and warranties (backed by insurance if needed) can address risk allocation. For key concerns like employee retention or customer relationships, I might recommend specific provisions in the purchase agreement or separate management agreements. The goal is to create a structure that provides appropriate incentives and protections for both parties while keeping the deal executable. Success often comes from understanding which issues are truly material versus those where compromise is possible.

To further develop your investment banking expertise, consider exploring DataCamp's Finance Fundamentals in Python course for advanced financial modeling and Financial Analysis in Power BI to enhance your ability to analyze and present complex financial data to clients.

Final Thoughts

Success in financial analyst interviews stems from the powerful combination of technical expertise and practical experience. The field continues to evolve with new technologies and methodologies, making continuous learning essential for career growth.

Professional certifications like the CFA, FRM, or specialized technical certifications can differentiate you in a competitive market. Building a portfolio of financial analysis projects, joining investment competitions, or contributing to open-source financial analysis tools provides tangible evidence of your capabilities.

Each interview presents an opportunity to showcase not just your technical knowledge but also your analytical thinking process and problem-solving abilities. Your success will come from demonstrating how you apply your expertise to real business challenges while continuing to grow.

Elevate Your Finance Team's Data Skills

Train your finance team with DataCamp for Business. Comprehensive data and AI training resources and detailed performance insights to support your goals.

As an adept professional in Data Science, Machine Learning, and Generative AI, Vinod dedicates himself to sharing knowledge and empowering aspiring data scientists to succeed in this dynamic field.

FAQs

How long should I prepare for a financial analyst interview?

Typically, candidates should spend 2-4 weeks preparing, focusing on both technical concepts and behavioral questions. For career changers, 4-6 weeks may be more appropriate.

What software skills are most important for financial analyst roles?

Excel proficiency is essential, with special focus on financial modeling and pivot tables. Additional valuable skills include SQL, Bloomberg Terminal, and visualization tools like PowerBI.

Do I need a CFA certification to become a financial analyst?

While not mandatory for all positions, CFA certification is highly valued, especially for investment-focused roles. Many entry-level positions don't require it, but pursuing it can accelerate career growth.

What's the typical career progression for a financial analyst?

The common path is Junior Financial Analyst (1-3 years) → Senior Financial Analyst (3-5 years) → Financial Manager/Director (5+ years), with opportunities to specialize in areas like investment banking or corporate finance.

What's the difference between a financial analyst and a data analyst?

Financial analysts focus specifically on financial data and business performance metrics, while data analysts work with broader datasets across various business functions. Financial analysts typically need deeper knowledge of accounting and financial principles.