Track

AI and insurance are the story of a long-term and successful relationship. Although the sector is sometimes regarded as conservative when it comes to the adoption of new technologies—especially compared with big tech, finance, or banking—the truth is that, since AI started to deliver its promises in the field of machine learning and deep learning, the sector has steadily embraced the new possibilities these technologies bring.

Today, AI is ubiquitous in countless daily tasks of insurers, from risk assessment and fraud detection to customer services and claims processing. With the rise of generative AI, the sectors are rapidly experiencing a new revolution that will optimize the business in unpredictable ways, thereby unlocking significant economic value. According to estimates from McKinsey, AI technologies could add up to $1.1 trillion in annual value for the global insurance industry.

In this article, we will analyze how AI is changing the insurance sector. We will cover the main technologies behind this revolution, illustrative use cases, as well as potential challenges and ethical considerations.

Explore how a large financial company successfully introduced LLMs into their organization with our webinar, Bringing Generative AI to the Enterprise.

Elevate Your Organization's AI Skills

Transform your business by empowering your teams with advanced AI skills through DataCamp for Business. Achieve better insights and efficiency.

What is AI in insurance?

The insurance industry is one of the most data-rich sectors. As such, it’s not surprising that AI's potential in insurance is enormous. It is opening the gate to new gains in operational efficiency, improved customer experience, and augmented decision-making.

Following the COVID-19 pandemic, the priorities of insurance customers are changing, shifting towards more on-demand and personalized services. In this context, next-generation AI tools are key for insurers to provide services that meet the needs of customers.

A snapshot of the insurance industry. Source. DataCamp

With this shifting paradigm in the sector, insurance companies have embarked on a journey of profound changes, where investment in new technologies, including machine learning and generative AI, is key to driving profits and surviving in an ever-evolving competitive landscape. As Sudaman Thoppan Mohanchandralal explains in the DataFramed podcast:

The insurance sector is witnessing two important, interrelated milestones: there is a change from a technological perspective, but also a behavioral change from a customer perspective.

Sudaman Thoppan Mohanchandralal, Regional Chief Data and Analytics Officer at Allianz Benelux

However, as a nascent technology, where and how to properly implement AI solutions is a challenging task for AI practitioners in insurance companies. Let’s analyze the main AI technologies that are transforming insurance.

Key AI Technologies Transforming Insurance

We can highlight two core technologies that are rapidly reshaping insurance: machine learning –which has been largely used by insurers in the last two decades– and, more recently, generative AI solutions.

- Traditional AI and machine learning. Over the last decades, insurers have adopted machine learning solutions to increase predictive analytic capabilities. Machine learning models are key in areas like fraud detection in insurance claims, improving customer retention, and optimizing prices in time series. At the same time, machine learning is behind the natural language processing (NLP) capabilities of modern chatbots that insurers have used for customer service purposes. You can learn more about the importance of data science and machine learning in insurance in a separate DataCamp article.

- Generative AI. While traditional AI and machine learning will still play an important role in the many daily routines of insurers, generative AI is certainly the next big thing. Generative AI tools, like ChatGPT, are poised to revolutionize the insurance industry by advancing personalized insurance products, improving customer experience, and reshaping marketing strategies.

If you are a newcomer to generative AI and machine learning, our AI Fundamentals Skill Track is a great place to get started in today’s most valuable and revolutionary technology.

AI in Insurance Applications in Different Sectors

AI plays a critical role in insurance no matter the type of business. In this sector, we cover the most popular applications in traditional types of insurance: health insurance, auto insurance, and life insurance.

AI in health insurance

Health insurances cover the medical expenses of the beneficiary as a result of sickness or injury. Insurers in this sector are using AI to optimize the pricing of insurance plans, also called risk premium modeling.

By leveraging predictive analytics, insurers can assess with unprecedented accuracy the customer’s risk profile, which is key to offering competitive pricing to individuals. For example, understanding and predicting future disease risks with AI is critical in portfolio optimization and pricing.

While predicting complex phenomena like the COVID-19 pandemic would have been challenging, understanding and predicting health outcomes will enable insurers to prioritize and personalize their services.

A great example of AI-driven health insurance initiatives is Wisedocs, a platform that uses AI to automatically review, analyze, and summarize long medical records, saving up to 30% of the time it would take if done manually. As Connor Atchison, its founder and CEO, puts it:

Processing complex medical records for any aspect of the insurance ecosystem is laborious and error-addled work. Reviews could be automated with AI, yet the industry has remained largely unchanged.

As Connor Atchison, Wisedocs Founder and CEO

AI in auto insurance

Auto insurances protect beneficiaries against financial loss in the event of a car accident or theft. Insurers around the world are exploring the possibilities of data and AI to improve the automotive insurance business.

One of the most illustrative use cases is the assessment of drivers’ risk profile. Machine learning and deep learning models are used to create granulated categories of customers based on data, such as their driving record, the type of cars they drive, or even their credit history. Telematic data, including from the car itself and the phone used within the vehicle, has the potential to drastically increase the accuracy of these models.

Doug McElhaney, a partner within the insurance practice at McKinsey & Company, speaks about these new possibilities in this article:

The presence of telematics products offers carriers increased confidence. With a telematics-based product, the carriers have moved from a static rating approach to a usage-based insurance product.

Doug McElhaney, Partner within the Insurance Practice McKinsey & Company

Another important use case is related to fraud detention. With AI and machine learning, insurers can have a better idea of drivers’ behavior, which is key to spotting potential fraudulent claims. Variables that could be tracked to raise red flags are the expected miles that will be driven annually, the garage location of where a vehicle is parked, or the extent of someone’s injuries after an accident or appropriate medical treatments.

Matthew Carrier, principal at Deloitte Consulting, highlights the benefits of AI for fraud detection:

The efforts by insurance companies to reduce fraud ultimately benefit consumers by lowering the cost of insurance policies.

Matthew Carrier, Principal at Deloitte Consulting

AI in life insurance

Life insurance is a contract in which an insurer guarantees payment to an insured's beneficiaries when the insured dies.

There are enormous possibilities for AI in the life insurance sector. Given the long-term nature of these kinds of services (the terms of life insurance contracts can expand anywhere from 1 to 40 years or longer), providing a fair premium price is key for boosting customer satisfaction and retention. That’s why AI is becoming a key tool during the underwriting process.

These tools are used throughout the whole process, from data collection and evaluation, to risk assessment and premium calculation.

AI in Insurance Daily Tasks

Let’s analyze in detail how AI and machine learning work in some of the most common day-to-day operations of insurers.

AI in insurance underwriting

Underwriting is an evaluation process where an insurer assesses whether an applicant is insurable and calculates his policy premium. The underwriting process is common in all kinds of insurance, from health and life insurance to automobile and travel insurance.

The underwriting process aims to set a fair premium based on individuals’ risk profile. This has been traditionally a tedious and time-consuming process, that requires the collection and evaluation of vast amounts of data, often sorted chaotically and fragmentally. Traditional underwriting is prone to errors and complexities, making the process lengthy, inefficient and cumbersome. Limited capacity to address underwriting often leads to higher premiums and a lack of personalization.

This is where AI and machine learning enter the scene. Advanced data analytics plays a crucial role in modern underwriting, increasing operational efficiency, enhancing accuracy in risk assessments and enabling insurers to offer personalized policies.

A great example of how AI can help underwriting processes is Indigo, a company specializing in medical professional liability insurance. Its AI-powered underwriting process examines thousands of data points to provide pricing that is customized to the needs of healthcare practitioners and their medical specialities.

AI in insurance claims processing

Claims are the other side of the coin in the insurance business. A claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event.

As occurred with underwriting, processing claims has been historically a repetitive, time-consuming task, that involves the thorough analysis of every specific case and the information provided by the insured. This process often leads to human error and serious bottlenecks, and the likelihood of suffering fraud is relatively high.

AI is revolutionizing insurance claim processing. By analyzing vast amounts of data, streamlining the claims management process, and automating routine tasks, AI tools can improve efficiency, spot potential fraud with higher accuracy, and free up insurance agents to concentrate on other tasks.

A great case study to illustrate the effects of AI in claim processing can be found in this article, where a Nordic insurance company was able to automatically analyze 70% of the documents following the implementation of an AI solution developed by EY wavespace Madrid.

Challenges and Considerations for AI Adoption in Insurance

While the benefits of AI are clear, implementing a successful AI solution is not always easy, especially in a sector like insurance, where there is a lot of sensitive data involved. Let’s analyze the most important challenges.

Ethical and regulatory challenges

Despite the unique capabilities of AI, it’s important to consider its potential risks and regulatory concerns in the insurance sector. Christian Westermann, Zurich’s Head of AI, summarizes the main concerns from a technical perspective:

You must ensure that your models are reliable, that you address bias, that your solution is robust and explainable, and that you are transparent and accountable when using AI.

But generative AI introduces new risks, such as misinformation and deep fakes, leading to an increase in the professionalism of fraud and the sophistication of cyberattacks, wherein AI probes weaknesses in a network and finds a strategy to penetrate it.

Christian Westermann, Zurich’s Head of AI

In addition, compliance with the rapidly evolving legal landscape is mandatory for insurers to ensure data protection and fair and safe use of AI. A great example of how the future of compliance will look is the recently approved EU AI Act, a comprehensive regulation that requires companies, including insurers, to advance strict regulatory measures.

Check out our EU AI Act Fundamentals Skill Track to learn about this innovative and ambitious rule and how to stay compliant.

Christian Westermann advances the main implications of the EU AI Act for the insurance business:

The EU AI Act has outlined what type of AI is considered as high, medium, or low risk across industries, including insurance. For example, the use of AI in underwriting in life and health is, according to this new regulation, high risk. In addition, the AI Act uses a rather broad definition of AI. As such, insurance carriers need to assess if and how they are impacted by this regulation.

Christian Westermann, Zurich’s Head of AI

Integrations and scalability

How to integrate AI solutions with existing systems and make them scalable can be complex and requires modern infrastructure, which many insurance companies lack. These companies usually have legacy systems that may not easily interface with cutting-edge AI tools.

Combining machine learning and artificial intelligence technologies into these established processes requires careful planning and customization to avoid disruptions. Insurance companies need to assess their current infrastructure, identify potential integration challenges, and invest in necessary upgrades to ensure that both systems work harmoniously with existing technologies.

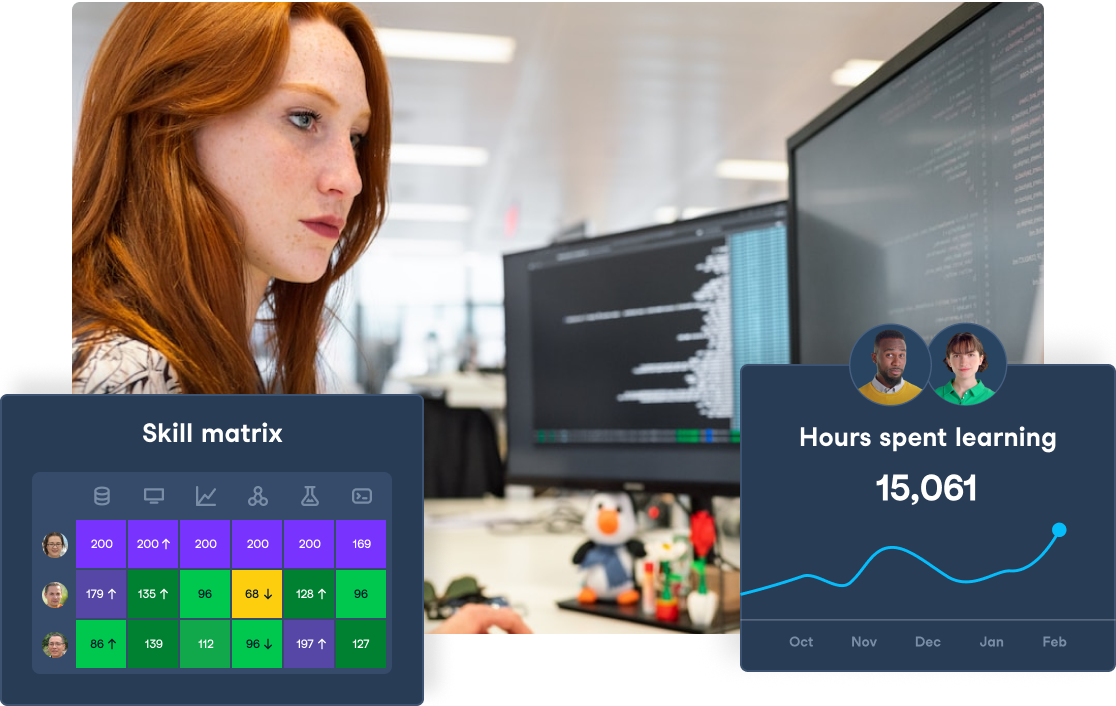

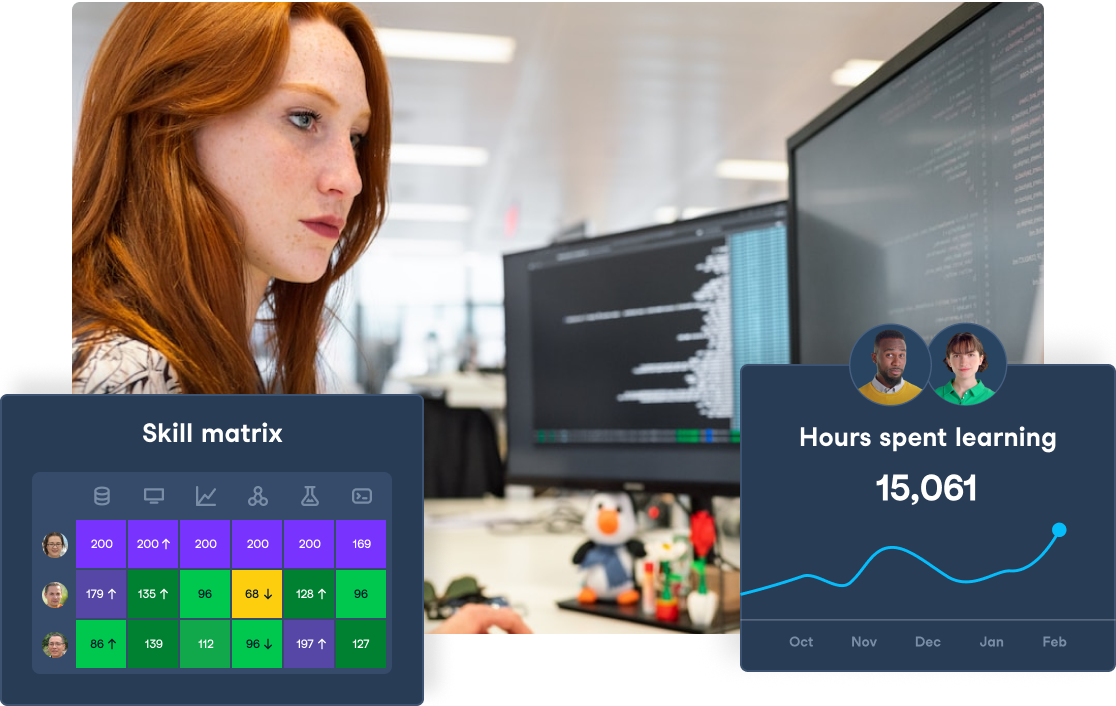

Upskilling teams and people

Building a successful AI strategy requires considerable effort and resources, but even companies with big pockets fail to implement AI solutions. Why? Because they lack enough skilled employees with AI literacy.

Successful implementation and management of AI systems require a skilled workforce. Data scientists, AI specialists, and other professionals with AI and machine learning expertise are essential for developing, interpreting, and managing these technologies.

Recruiting and retaining talent with the proper skill set can be challenging, especially given the competitive market for tech professionals. Investing in training and development for existing staff can also help bridge the skills gap and ensure that the organization can fully leverage AI capabilities. As seen in the graph below, one of the most prominent barriers to AI adoption in drug discovery is the lack of suitable staff and a lack of understanding of AI.

Fortunately, DataCamp is here to help insurers. With our DataCamp for Business solution, we can help your company become data and AI literate. With a scalable solution that can work for teams of any size, along with customizable learning paths and detailed reporting, DataCamp for Business can help you transform your business and become AI-ready.

We are happy to share our expertise with consolidated insurance companies like Allianz. In this case study, we explore How Allianz upskilled 6,000+ employees with DataCamp.

Insurance has a specific value proposition and business model, so it was important to give our colleagues the opportunity to apply their learnings to as close to real-insurance use cases as possible.

Elizabeth Reinhart, AI and Data Analytics Capability Building Senior Manager, Allianz

Elevate Your Organization's AI Skills

Transform your business by empowering your teams with advanced AI skills through DataCamp for Business. Achieve better insights and efficiency.

Future Trends in AI for Insurance

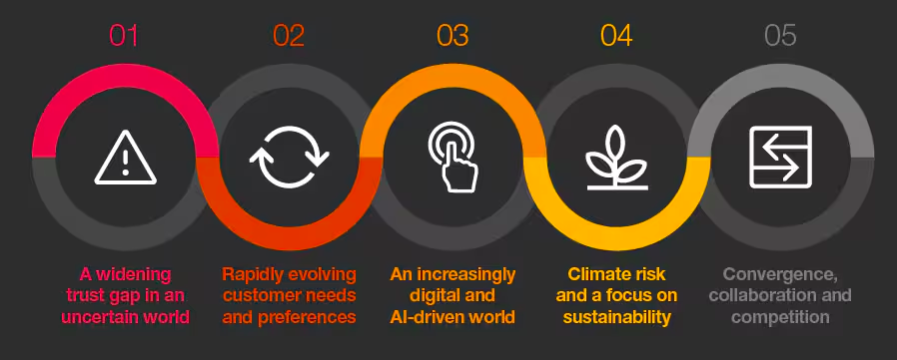

The insurance sector has embarked on a journey of changes in recent years with unpredictable implications. The world is changing, and so is the insurance sector, which is facing five important trends, according to PWC:

Five trends affecting the future of insurance. Souce. PWC

Against this backdrop, AI solutions and cutting-edge technologies, like blockchain or the Internet of Things, will play an important role in the strategies for insurance companies to navigate the uncertainties of today’s world.

Conclusion

AI is one of the key drivers of change in the insurance sector. The application of AI and machine learning in insurance has the potential to speed up the underwriting process and automate climate processing, thereby increasing operational efficiency and improving customer satisfaction and retention by offering more personalized policies.

As these systems become smarter, insurance companies with a solid grasp of AI fundamentals are likely to hold a significant edge over their competitors. We will tell you more about the importance of having a solid data and AI culture in our upcoming webinar Increasing Your Organization's Data and AI Maturity

Request a demo to learn how DataCamp can guide you through the process of upskilling your entire team and building a data-positive culture. In the meantime, check our dedicated materials on AI:

- AI Fundamentals

- AI Fundamentals Certification

- How to Learn AI From Scratch in 2024: A Complete Expert Guide

- The Future of Data Science in Insurance Webinar

- Data Science in Insurance Today | DataCamp

- AI in Finance: Revolutionizing the Future of Financial Management

- AI in Banking: How AI is Transforming the Banking Industry

- AI in Healthcare: Enhancing Diagnostics, Personalizing Treatment, and Streamlining Operations

- Hands-on data and AI training for your finance team

- 10 Ways to Use ChatGPT for Finance

- What is the EU AI Act? A Summary Guide for Leaders

- EU AI Act Fundamentals

I am a freelance data analyst, collaborating with companies and organisations worldwide in data science projects. I am also a data science instructor with 2+ experience. I regularly write data-science-related articles in English and Spanish, some of which have been published on established websites such as DataCamp, Towards Data Science and Analytics Vidhya As a data scientist with a background in political science and law, my goal is to work at the interplay of public policy, law and technology, leveraging the power of ideas to advance innovative solutions and narratives that can help us address urgent challenges, namely the climate crisis. I consider myself a self-taught person, a constant learner, and a firm supporter of multidisciplinary. It is never too late to learn new things.