Course

When analyzing data that involves counting events - like the number of customer complaints per day, hospital admissions per month, or website clicks per hour - ordinary linear regression often produces misleading results. Count data has unique characteristics that require specialized modeling approaches.

Poisson regression provides a statistical method specifically designed for count data. Unlike linear regression, which can predict negative values, Poisson regression ensures predictions remain non-negative integers. This makes it particularly valuable any field where counting events is central to decision-making.

If you're new to regression analysis, our Introduction to Regression in R course provides essential foundational concepts you'll need for this tutorial. For those ready to explore the broader family of regression techniques, Generalized Linear Models in R offers comprehensive coverage of the statistical framework that includes Poisson regression.

Understanding Count Data and Its Challenges

What makes count data special

Count data represents the number of times something happens within a fixed period or space. Examples include the number of insurance claims filed per policy per year or the number of traffic accidents at an intersection per month.

Count data has several distinctive properties that make ordinary linear regression inappropriate:

- Non-negative integers only: Counts cannot be negative or fractional.

- Right-skewed distribution: Most count datasets show many low values with occasional high values, creating a characteristic right tail.

- Variance increases with the mean: As average counts get higher, the variability typically increases too.

Why linear regression fails

Consider predicting the number of customer complaints based on factors like product complexity and customer satisfaction scores. Linear regression treats this like any continuous outcome, potentially predicting impossible values like -1.5 complaints or 14.7 complaints.

More problematically, linear regression assumes constant variance across all prediction levels. In reality, weeks with higher predicted complaint counts will likely show more variability than weeks with low predicted counts. This pattern, called heteroscedasticity, leads to unreliable confidence intervals and hypothesis tests.

The Poisson distribution foundation

Poisson regression builds on the Poisson probability distribution, which naturally describes count data. The Poisson distribution has a single parameter (lambda) that represents both the mean and variance of the counts. This equal mean-variance property, called equidispersion, is a key assumption we'll need to verify in practice.

The distribution excels at modeling "rare" events - not necessarily infrequent, but events where each individual occurrence is independent and the rate remains relatively constant under similar conditions.

When to Use Poisson Regression

First, let’s talk about the ideal conditions under which Poisson regression performs well. Then, we can talk about the real applications.

Ideal scenarios

Poisson regression works best when your data meets several conditions:

- Independent events: Each occurrence doesn't influence others. One insurance claim doesn't make another more or less likely (assuming no fraud patterns).

- Constant rate: Under similar conditions, the average rate of events remains stable. Emergency room visits might vary by day of week, but Tuesdays in similar months should show consistent patterns.

- Proper time or space frame: Events are counted over clearly defined periods or areas. "Complaints per month" is better than "complaints sometimes counted daily, sometimes weekly."

- No obvious excess zeros: While some zeros are expected, if your data has many more zeros than the Poisson distribution would predict, you might need specialized zero-inflated models.

Common applications

In healthcare and epidemiology, researchers track disease cases across regions or time periods, adjusting for population. For instance, they may study how vaccination rates influence infections per 100,000 people.

In business and marketing, teams examine customer behavior like purchase frequency, support tickets, or engagement. E-commerce companies often model daily orders based on marketing spend, seasonality, and promotions.

Or here is a common example often mentioned with Poisson regression: Manufacturing teams monitor defect rates by batch size or inspection period to catch quality issues early and improve processes.

Understanding Model Structure and Assumptions

The log-link connection

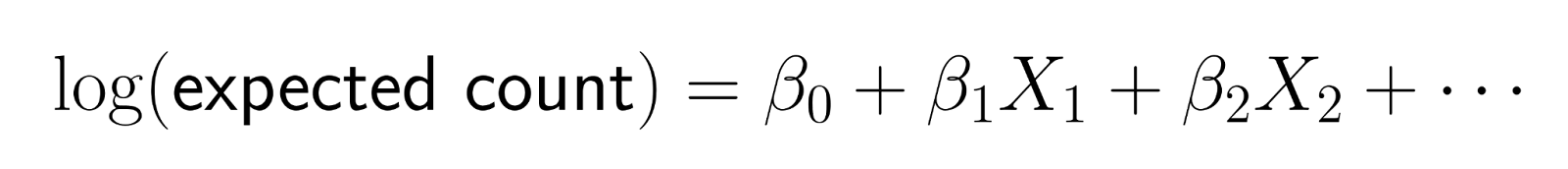

Poisson regression doesn't model counts directly. Instead, it models the logarithm of the expected count as a linear combination of predictors.

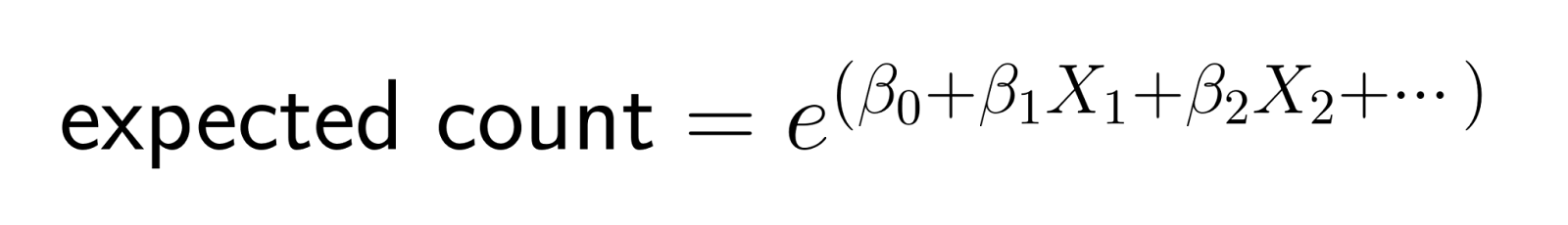

This logarithmic transformation, ensures predictions remain positive. Specifically, the log-link function transforms the expected count to the log scale, ensuring that model predictions for the mean count remain strictly positive. When we reverse the transformation (by exponentiating), we get:

This structure means that changes in predictors have multiplicative effects on the expected count.

Interpreting multiplicative effects

In linear regression, increasing a predictor by one unit adds a constant amount to the outcome. In Poisson regression, increasing a predictor by one unit multiplies the expected count by a constant factor.

For example, if the coefficient for "marketing spend" is 0.1, then each additional dollar of marketing spend multiplies the expected number of customers by e^0.1 ≈ 1.105, representing about a 10.5% increase.

Even though it seems more complicated, this characteristic can be intuitive for business applications, where we often think in terms of percentage changes and relative effects.

Key assumptions to verify

As with any model, there are some assumptions we need to pay attention to:

- Independence: Observations shouldn't influence each other. If you're analyzing daily counts over time, strong temporal patterns might indicate dependence that requires more sophisticated modeling.

- Equidispersion: The variance should approximately equal the mean. Calculate this ratio for your data - values much greater than 1 suggest overdispersion that needs addressing.

- Correct functional form: The relationship between predictors and log-count should be roughly linear. Non-linear relationships might require polynomial terms or transformations.

- No severe outliers: Extreme count values can disproportionately influence results. Investigate whether outliers represent data errors or genuine extreme events.

Working with Exposure and Offsets

Understanding exposure variables

Many count datasets involve different exposure levels - varying time periods, population sizes, or observation intensities. For example, comparing accident counts between cities requires accounting for population differences, or comparing monthly sales figures requires noting that some months have different numbers of days.

Exposure variables represent the "denominator" that makes counts comparable. Without proper adjustment, larger cities will trivially have more accidents, and longer months will have higher sales, potentially masking the true relationships you want to study.

Implementing offsets

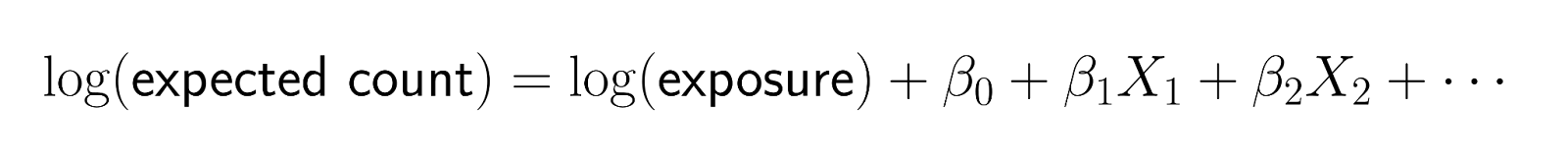

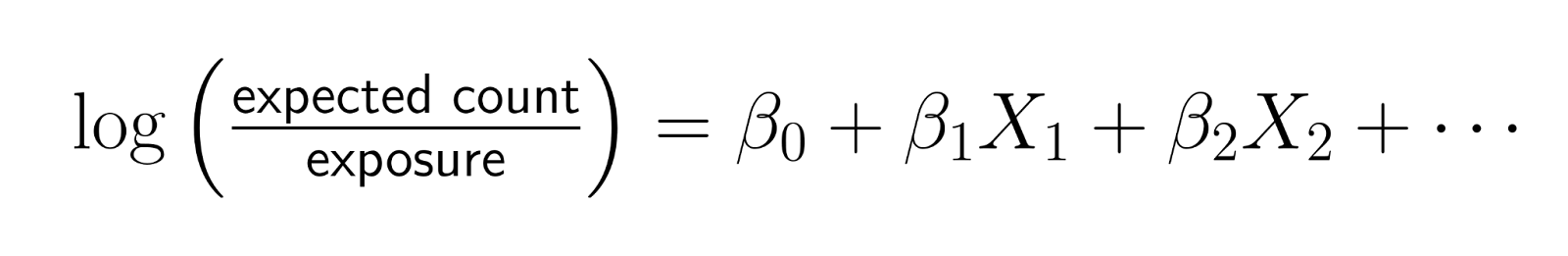

Offsets provide a way to incorporate exposure variables with a coefficient fixed at 1. Instead of modeling raw counts, offsets allow you to model rates while maintaining the count structure of your data.

The mathematical form becomes:

Rearranging this equation:

This shows that you're effectively modeling the log-rate, where rate = count/exposure.

When this thinking is useful

- Population-adjusted disease rates: When comparing COVID-19 case counts across counties, include log(population) as an offset. This way, coefficients represent effects on cases per person rather than total cases.

- Time-adjusted business metrics: If analyzing monthly sales with some months having different promotional periods, include log(promotional_days) as an offset to study sales per promotional day.

- Area-adjusted environmental data: When counting species sightings across different habitat patches, include log(area_surveyed) as an offset to model species density rather than raw counts.

The offset ensures that doubling the exposure doubles the expected count (all else equal), which is the natural relationship for rate-based phenomena.

Interpreting Coefficients and Results

From coefficients to incidence rate ratios

Raw Poisson regression coefficients represent changes in the log-count, which can be difficult to interpret directly. Exponentiating coefficients transforms them into incidence rate ratios (IRRs), which have intuitive interpretations.

An IRR represents the multiplicative change in the expected count for a one-unit increase in the predictor:

- IRR = 1.0: No effect (predictor doesn't change the rate)

- IRR = 1.2: 20% increase in the rate

- IRR = 0.8: 20% decrease in the rate

- IRR = 2.0: 100% increase (doubling the rate)

Interpreting different predictor types

- Continuous predictors: If age has an IRR of 1.03, each additional year of age multiplies the expected count by 1.03, representing a 3% increase. For a 10-year age difference, the effect would be 1.03^10 ≈ 1.34, or about a 34% increase.

- Binary predictors: If gender (male vs. female) has an IRR of 1.5, males have 1.5 times the rate of the outcome compared to females, representing a 50% higher rate.

- Categorical predictors: With multiple categories, each level gets compared to a reference category. If "winter" has an IRR of 0.7 compared to "summer," winter months show 30% fewer events than summer months.

Understanding confidence intervals

IRR confidence intervals provide uncertainty estimates around your rate ratios. An IRR of 1.25 with a 95% confidence interval of [1.10, 1.42] suggests you can be reasonably confident the true effect represents between a 10% and 42% increase in the rate.

If a confidence interval includes 1.0, the effect might not be statistically significant. For example, an IRR of 1.15 with CI [0.95, 1.39] suggests the predictor might have no effect.

Practical communication strategies

When presenting results to non-technical audiences, focus on percentage changes rather than ratios. Instead of saying "the IRR is 1.3," say "this factor is associated with a 30% increase in the event rate."

Provide concrete examples: "Based on our model, increasing marketing spend by $1000 is associated with approximately 15% more customer acquisitions, from an average of 20 to about 23 customers per month."

Implementing Poisson Regression in R

Now that we have gone through the detail of interpretation, let’s implement in R.

Data preparation and exploration

Before fitting any model, examine your count data carefully. Start by loading necessary libraries and exploring the distribution:

library(ggplot2)

library(dplyr)

# Example: Website daily visitor counts

data <- data.frame(

visitors = c(42, 48, 39, 52, 44, 58, 51, 47, 41, 49, 40, 46, 43, 54, 50),

day_of_week = factor(c("Mon", "Tue", "Wed", "Thu", "Fri", "Sat", "Sun",

"Mon", "Tue", "Wed", "Thu", "Fri", "Sat", "Sun", "Mon")),

marketing_spend = c(200, 150, 180, 250, 220, 400, 350, 300, 160, 190,

140, 210, 380, 420, 170),

temperature = c(22, 25, 19, 24, 26, 28, 30, 27, 21, 23, 18, 25, 29, 31, 20)

)

# Check mean vs variance (should be similar for Poisson)

mean(data$visitors)

var(data$visitors)

var(data$visitors) / mean(data$visitors) # Should be close to 1

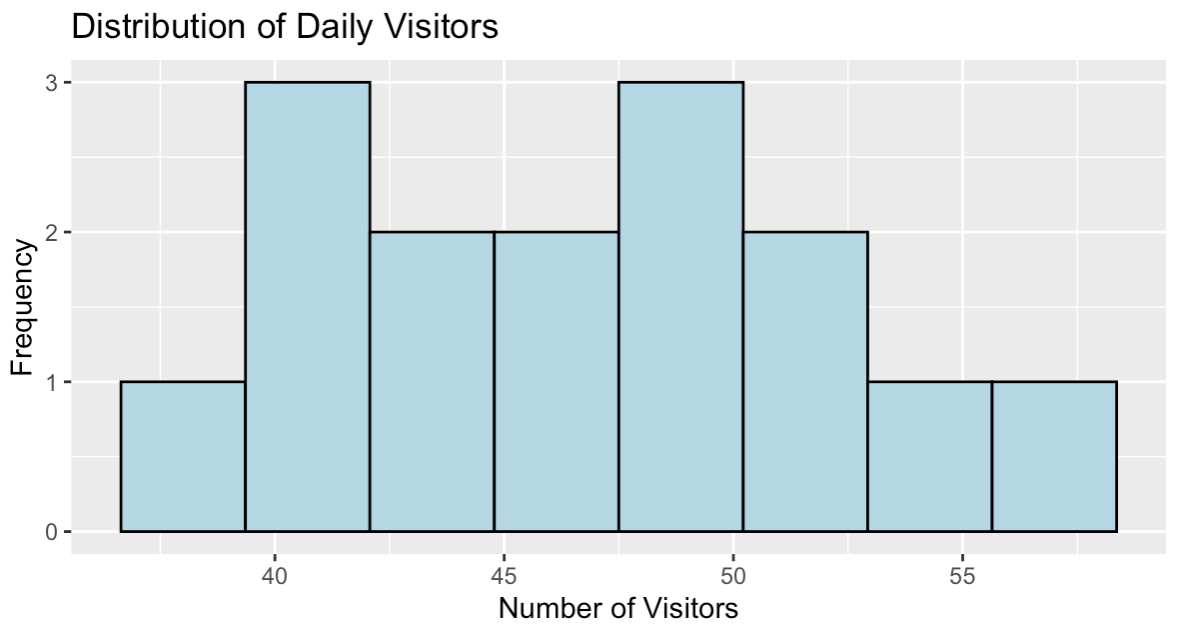

# Visualize the distribution

ggplot(data, aes(x = visitors)) +

geom_histogram(bins = 8, fill = "lightblue", color = "black") +

labs(title = "Distribution of Daily Visitors",

x = "Number of Visitors", y = "Frequency")> mean(data$visitors)

[1] 46.93333

> var(data$visitors)

[1] 30.35238

> var(data$visitors) / mean(data$visitors)

[1] 0.6467127The variance-to-mean ratio of 0.65 is reasonably close to 1, indicating our data is well-suited for Poisson regression. While not exactly equal, ratios between 0.5 and 1.5 are generally acceptable and suggest the Poisson distribution provides a good foundation for modeling this count data.

Distribution of daily website visitors. Image by Author.

The histogram shows a roughly symmetric distribution of visitor counts centered around 47 visitors per day, with values ranging from about 39 to 58. This distribution pattern is consistent with count data that can be effectively modeled using Poisson regression.

Fitting the model

The glm() function with family = poisson fits Poisson regression models:

# Basic Poisson regression

model <- glm(visitors ~ day_of_week + marketing_spend + temperature,

family = poisson, data = data)

# View key model results

summary(model)

# Calculate Incidence Rate Ratios (IRRs)

exp(coefficients(model))Here is the coefficients table:

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 3.2978122 0.5556601 5.935 2.94e-09 ***

day_of_weekMon 0.0724036 0.1635467 0.443 0.658

day_of_weekSat 0.0316265 0.2872878 0.110 0.912

day_of_weekSun 0.0339621 0.2502578 0.136 0.892

day_of_weekThu 0.1068756 0.1870821 0.571 0.568

day_of_weekTue 0.0442967 0.1633032 0.271 0.786

day_of_weekWed 0.0653789 0.1813230 0.361 0.718

marketing_spend 0.0001593 0.0018211 0.087 0.930

temperature 0.0186099 0.0317682 0.586 0.558Here are the incidence rate ratios (IRRs):

(Intercept) day_of_weekMon day_of_weekSat day_of_weekSun day_of_weekThu day_of_weekTue day_of_weekWed marketing_spend

27.053386 1.075089 1.032132 1.034545 1.112796 1.045292 1.067563 1.000159

temperature

1.018784 The coefficients show the log-scale effects, but the IRRs provide more intuitive interpretations. For example, Thursday (day_of_weekThu) has an IRR of 1.11, suggesting about 11% more visitors compared to Friday (the reference category). Marketing spend has an IRR of 1.0002, indicating each additional dollar increases expected visitors by about 0.02%.

Notice that if we calculated confidence intervals for these IRRs, many would include 1.0, suggesting the effects aren't statistically significant with this small sample. This is common with small datasets and demonstrates why sample size matters.

Including exposure with offsets

If your data has varying exposure periods, include them as offsets:

# Example with exposure data

data$exposure_days <- c(rep(7, 10), rep(6, 5)) # Some weeks had 6 observation days

# Model with offset

model_offset <- glm(visitors ~ day_of_week + marketing_spend + temperature +

offset(log(exposure_days)),

family = poisson, data = data)

summary(model_offset)Call:

glm(formula = visitors ~ day_of_week + marketing_spend + temperature +

offset(log(exposure_days)), family = poisson, data = data)

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) 1.734e+00 5.579e-01 3.109 0.00188 **

day_of_weekMon 2.371e-02 1.637e-01 0.145 0.88485

day_of_weekSat 9.873e-02 2.898e-01 0.341 0.73338

day_of_weekSun 1.208e-01 2.472e-01 0.489 0.62513

day_of_weekThu 5.642e-02 1.871e-01 0.302 0.76297

day_of_weekTue -6.713e-02 1.634e-01 -0.411 0.68128

day_of_weekWed -6.073e-02 1.825e-01 -0.333 0.73934

marketing_spend -4.231e-05 1.823e-03 -0.023 0.98149

temperature 8.210e-03 3.179e-02 0.258 0.79623Notice how the coefficients change dramatically when we include the offset. The intercept drops from 3.30 to 1.73, and all other effects become smaller. This transformation occurs because we're now modeling the rate per day rather than total counts over varying periods.

The offset ensures fair comparisons by adjusting for different exposure lengths. Without this adjustment, periods with more observation days would artificially appear to have higher visitor counts, potentially masking the true relationships we want to study. The model now answers "What's the daily visitor rate?" rather than "How many total visitors occurred?"

Making predictions

Generate predictions for new scenarios:

# Create new data for prediction

new_data <- data.frame(

day_of_week = factor("Fri", levels = levels(data$day_of_week)),

marketing_spend = 300,

temperature = 25

)

# Predict expected counts

predicted_counts <- predict(model, newdata = new_data, type = "response")

print(paste("Expected visitors:", round(predicted_counts, 1)))[1] "Expected visitors: 45.2"The model predicts 45.2 visitors for a Friday with $300 marketing spend and 25°C temperature. This prediction falls within the reasonable range of our observed data (39-58 visitors) and is close to our overall mean of 46.9 visitors.

Poisson regression naturally ensures predictions remain positive integers when rounded, unlike linear regression which could produce impossible negative values. The type = "response" parameter returns predictions on the original count scale rather than the log scale used internally by the model.

Essential Model Diagnostics

Checking for overdispersion

Overdispersion occurs when the variance exceeds the mean, violating a key Poisson assumption:

# Calculate dispersion statistic

residual_deviance <- model$deviance

df_residual <- model$df.residual

dispersion <- residual_deviance / df_residual

print(paste("Dispersion statistic:", round(dispersion, 3)))

if (dispersion > 1.5) {

print("Possible overdispersion detected")

print("Consider quasi-Poisson or negative binomial models")

}[1] "Dispersion statistic: 0.849"The dispersion statistic of 0.849 is close to 1, indicating our model fits the data well without significant overdispersion. Values close to 1 suggest the Poisson assumption of equal mean and variance is reasonable for this dataset.

Since the statistic is below 1.5, no warning message appears, confirming that standard Poisson regression is appropriate. If this value were much larger than 1 (typically above 1.5), we would need to consider quasi-Poisson or negative binomial models to account for the extra variability.

Residual analysis

Examine residuals to detect patterns or model violations:

# Calculate Pearson residuals

fitted_values <- fitted(model)

pearson_residuals <- residuals(model, type = "pearson")

# Plot residuals vs fitted values

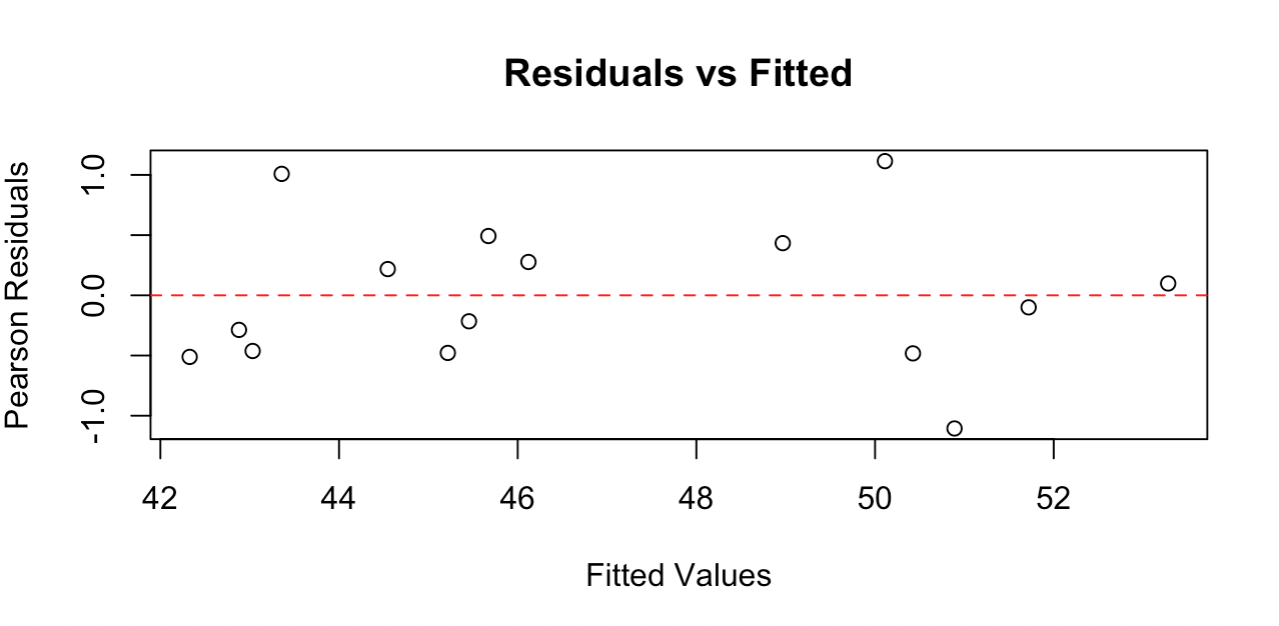

plot(fitted_values, pearson_residuals,

xlab = "Fitted Values", ylab = "Pearson Residuals",

main = "Residuals vs Fitted")

abline(h = 0, col = "red", lty = 2)

Residual plot showing random scatter around zero. Image by Author.

The residual plot shows points randomly scattered around the zero line with no clear patterns, indicating our model fits the data well. The residuals range roughly from -1 to +1, which is reasonable for this sample size.

Good residual plots should show: random scatter around zero (no curved patterns), roughly constant spread across fitted values (no funnel shapes), and no extreme outliers. This plot meets all these criteria, confirming that Poisson regression assumptions are satisfied and our model provides reliable results.

Handling overdispersion

If overdispersion is detected, consider quasi-Poisson models that adjust standard errors:

# Fit quasi-Poisson model

quasi_model <- glm(visitors ~ day_of_week + marketing_spend + temperature,

family = quasipoisson, data = data)Since our model shows good dispersion (0.849), quasi-Poisson adjustments aren't needed here. However, this approach provides more conservative confidence intervals and p-values when variance exceeds the mean, making it a valuable tool for real-world count data that often exhibits overdispersion.

Presenting and Interpreting Results

Creating clear result summaries

Transform model output into business-relevant insights by focusing on the practical meaning of your IRRs. When your model shows that weekend days have an IRR of 1.4 compared to weekdays, communicate this as "weekends see about 40% more visitors than weekdays." When marketing spend has an IRR of 1.002, explain that "each additional dollar in marketing is associated with about a 0.2% increase in visitors."

For continuous variables, consider presenting effects at meaningful intervals. Instead of discussing the effect of a single degree temperature change, show the impact of a 10-degree difference, which might be more relevant for business planning.

Understanding model limitations

Poisson regression identifies associations, not causal relationships. A strong association between marketing spend and visitor counts doesn't prove that marketing causes the increase. Other factors might influence both variables. Acknowledge this limitation when presenting results.

The model assumes the rate remains constant for given predictor values. If your business has seasonal trends not captured by your variables, or if the relationship between predictors and outcomes changes over time, your model might not generalize well to future periods.

Common Challenges and Solutions

Dealing with zero counts

Count data often contains zeros, which are perfectly valid in Poisson regression. However, if your data has many more zeros than a Poisson distribution would predict, this might indicate a different data-generating process. Some observations might represent periods or conditions where the event simply cannot occur, rather than periods where it could occur but didn't.

For example, website visitor counts might include zeros for days when the site was down for maintenance. These "structural zeros" are different from "random zeros" that occur naturally in Poisson processes.

Model-building strategy

Start with your most important predictors based on domain knowledge. Add variables one at a time and assess whether they improve your understanding of the data. More complex models aren't always better.

Pay attention to the practical significance of effects, not just statistical significance. A statistically significant 1% change in event rates might not justify business action, while a 20% change that's marginally non-significant might still warrant investigation with more data.

Handling violations

When equidispersion fails (variance much larger than mean), quasi-Poisson regression provides a simple solution. It keeps the same model structure but adjusts standard errors to account for the extra variability. This produces more conservative confidence intervals and p-values.

For severe overdispersion, negative binomial regression explicitly models the extra variation. This approach estimates both the mean relationship and the additional variability.

Best Practices and Recommendations

Avoiding common mistakes

Don't ignore overdispersion - it's one of the most common violations of Poisson assumptions and can severely affect your conclusions. Always check the variance-to-mean ratio and consider alternatives when necessary.

Be cautious about extrapolating beyond your data range. If your marketing spend data ranges from $100 to $1000, don't confidently predict effects for $5000 spend levels. The relationship might not remain log-linear at extreme values.

Avoid treating all categorical predictors as having equal spacing between levels. Education categories (high school, some college, college graduate) might not have equal effects on your outcome variable.

Documentation and workflow

Document your modeling decisions, especially assumption violations and how you addressed them. If you discovered overdispersion but chose quasi-Poisson adjustments, note this decision and its implications for interpretation.

Conclusion

Poisson regression provides an effective framework for analyzing count data across many domains. As you apply these techniques to your own data, start with simple models and build complexity gradually based on both statistical evidence and domain expertise. When assumptions are violated, extensions like quasi-Poisson or negative binomial models offer good alternatives. The goal is not just statistical significance, but practical insights that inform better decisions.

If you are looking to deepen your regression expertise, our Intermediate Regression in R course covers advanced diagnostic techniques and modeling strategies that complement the Poisson regression skills you've learned here. Generalized Linear Models in R is another great option.

As an adept professional in Data Science, Machine Learning, and Generative AI, Vinod dedicates himself to sharing knowledge and empowering aspiring data scientists to succeed in this dynamic field.

Poisson Regression FAQs

What is Poisson regression used for?

Poisson regression is used to model count data - like the number of customer complaints per day, website visits per hour, or defects per batch. It's designed specifically for non-negative integer outcomes.

When should I use Poisson regression instead of linear regression?

Use Poisson regression when your outcome variable represents counts, has non-negative integers only, and shows a right-skewed distribution. Linear regression can predict impossible negative values for count data.

What are incidence rate ratios (IRRs) in Poisson regression?

IRRs are exponentiated coefficients that show the multiplicative change in the expected count for a one-unit increase in a predictor. An IRR of 1.2 means a 20% increase in the rate.

Can Poisson regression handle zero counts?

Yes, Poisson regression naturally handles zeros. However, if you have many more zeros than expected, consider zero-inflated models for better fit.

What is overdispersion and how do I handle it?

Overdispersion occurs when variance exceeds the mean (ratio > 1.5). Handle it by using quasi-Poisson regression, which adjusts standard errors, or negative binomial regression for severe cases.

How do I check if my data is suitable for Poisson regression?

Calculate the variance-to-mean ratio of your count variable - it should be close to 1. Also check for independence of observations and ensure you have a proper time/space frame for counting.