Track

Many accountants are leaving the profession, with the number of accountants in the U.S. falling by 15.9% since 2019. With such alarming statistics, leaders in the industry are likely to be searching for new ways to bolster their operations or attract talent and keep their businesses relevant. One solution that is gaining popularity is the use of artificial intelligence (AI) in accounting.

In this article, we'll explore the importance of AI in accounting, some real-life examples of AI implementations, and some possible challenges.

Elevate Your Finance Team's Data Skills

Train your finance team with DataCamp for Business. Comprehensive data and AI training resources and detailed performance insights to support your goals.

What is AI in Accounting?

Artificial Intelligence (AI) is a broad term that encompasses various technologies and techniques used to enable machines to perform tasks that would typically require human intelligence. AI in accounting is the application of these technologies and techniques in the field of accounting to automate processes, perform data analysis, and help make informed financial decisions.

AI can be implemented in various areas of accounting such as auditing, tax preparation, risk assessment, fraud detection, and financial reporting. Here are a few examples:

- Data entry and processing: AI-powered software can extract data from documents, such as receipts and invoices, and accurately input it into financial systems. This reduces the need for manual data entry by accountants, saving time and reducing the risk of errors.

- Predictive analytics: With large datasets and advanced algorithms, AI can analyze patterns and trends in financial data to make predictions about future outcomes. This enables accountants to make more informed decisions based on accurate forecasts.

- Fraud detection: AI can detect anomalies and flag suspicious transactions, reducing the risk of fraudulent activities going undetected.

- Process automation: Repetitive tasks like bank reconciliations and invoice processing can be automated through AI, freeing up accountants' time to focus on more complex tasks.

Overall, AI in accounting aims to streamline processes, reduce costs, and improve accuracy and efficiency.

Key Benefits of AI in Accounting

AI in accounting is becoming increasingly essential for the industry's competitiveness and survival.

In fact, according to The State of AI in Accounting Report 2024 by Karbon Magazine, 71% of respondents believe that AI will bring about a big change to their operations.

To explore the potential prospects of AI, let's look at some benefits it may provide to your organization.

1. Automation of repetitive tasks

AI technology is excellent at anything that requires repetition.

Therefore, AI can automate time-consuming accounting tasks such as data entry, invoice processing, and account reconciliation.

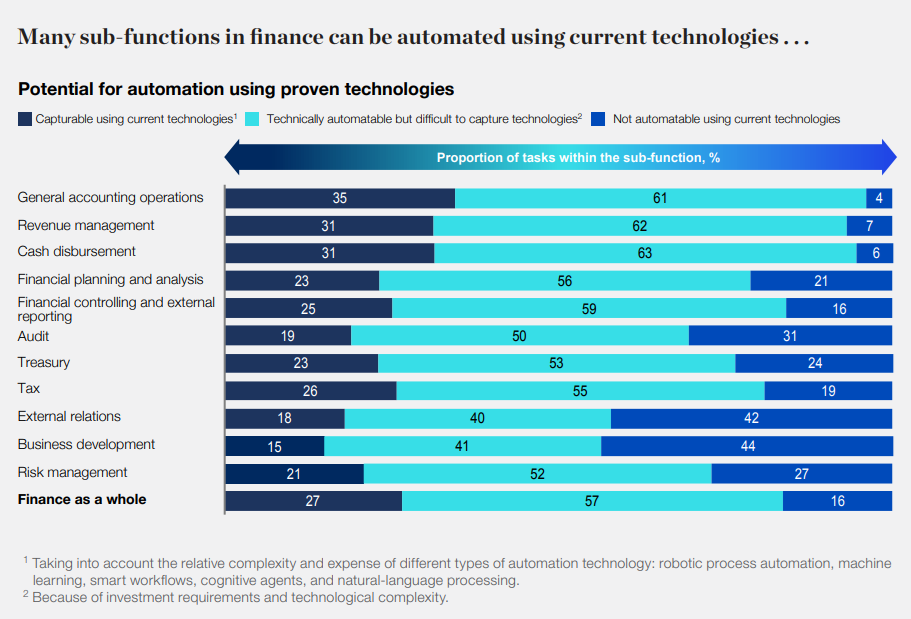

According to a report by McKinsey, many functions within finance and accounting can be automated.

As you can see from the image above, the general accounting operations sub-function has the highest proportion of tasks capturable by current AI technologies.

Companies adopting AI for automation purposes can free up accountants' time to focus on high-impact, strategic activities like financial analysis.

For example, AI-driven systems can automatically categorize transactions, reconcile accounts, and even generate financial statements, significantly reducing the manual effort required. A software company, Accountancy Cloud, has developed AI solutions to automate language or text-based tasks for their clients.

2. Improved accuracy and reduced errors

One of the significant advantages of AI in accounting is its ability to reduce human error. Tasks like bookkeeping and financial reporting can be error-prone when managed manually.

AI minimizes these risks by ensuring consistent data accuracy, which enhances the reliability of financial reports. This precision is crucial for businesses that rely on accurate financial data to make critical decisions.

3. Real-time financial insights

AI empowers businesses with real-time financial data analysis, allowing them to make quicker, informed decisions based on up-to-the-minute financial metrics.

Traditional accounting processes often delay reporting, but AI-driven platforms analyze data continuously, giving organizations immediate insights into cash flow, expenditures, and profitability.

According to J.P. Morgan, AI has the potential to revolutionize cash flow forecasting with AI through the analysis of enterprise data platforms, online media, and regulatory changes.

4. Cost savings and scalability

Adopting AI can lead to considerable cost savings as well. Time and resources spent doing extensive manual work can be saved, allowing organizations to operate with leaner accounting teams.

AI systems can handle massive datasets efficiently, enabling companies to scale their financial operations without a proportional increase in resources.

For example, an Artificial Intelligence Central Europe CFO Survey 2019 by Deloitte found a 40% improvement in effectiveness and 46% in cost reduction in companies that implemented AI for accounting.

How AI is Used in Accounting

The use of AI is relatively new to accounting, but the applications are already making an impact on the industry.

Here are some real-life examples of AI in accounting:

1. Fraud detection and risk management

AI plays a crucial role in detecting fraud by analyzing vast volumes of financial data to identify anomalies and suspicious transactions.

Advanced AI algorithms can:

- Assess patterns

- Recognize irregularities

- Alert accountants to potential fraud

These help to mitigate fraud within an organization.

For example, a bank partnered with Cognizant to create an AI neural network to identify fraudulent checks, saving $20M in fraud losses.

2. AI in auditing

AI also has the potential to transform the audit process. Traditionally labor-intensive tasks can be streamlined through the use of AI.

This is done by analyzing large datasets, reducing the need for manual sample testing, and identifying trends and anomalies that might go unnoticed by human auditors.

This allows auditors to focus on areas requiring professional judgment, thus enhancing the quality of audits.

However, this doesn’t mean the auditor is not involved in the process. According to KPMG, 64% of survey respondents expect auditors to conduct a more detailed review of the control environment in relation to their use of AI. This means that auditors are still required to govern and manage their use of AI in audits.

3. Predictive analytics for financial forecasting

AI-driven predictive analytics enable accountants to forecast future financial performance and trends with greater accuracy.

Analysis of historical data and external factors can enable AI models to project revenue, cash flow, and other financial metrics, aiding in budgeting and strategic planning.

4. Generative AI in financial reporting

Generative AI tools, such as language models, simplify the process of drafting financial reports and performing competitor analysis.

These tools can analyze vast amounts of information, generate summaries, and create automated communications, enabling accountants to produce high-quality reports efficiently.

For example, AI can be used for invoice processing, where it can automatically extract and categorize data from invoices, eliminating the manual effort required.

AI in Accounting and Auditing: Examples

AI is currently being explored and implemented in various areas in both the ‘Big Four’ and beyond. Let’s look at them below:

Big four use cases

Leading accounting firms from the big four have also implemented AI in their operations.

Here are some examples:

KPMG

In KPMG, innovations in AI are being implemented through the KPMG Ignite AI platform. This platform uses machine learning, deep learning and computer vision for various applications in accounting

EY

Ernst & Young Global Limited (EY) is also another competitor of the big four that has begun using AI in their services.

Here are some of their service offerings:

- Improved receivables collection: An AI assistant identifies “at risk” customers and recommends the next action for more efficient collection of Account Receivables.

- Intelligent financial commentary: Automation of standard and non-standard financial reports through the use of AI.

PWC

PwC, also known as PricewaterhouseCoopers, is collaborating with OpenAI to be a reseller of ChatGPT Enterprise, a key product focused on B2B.

The company also has plans to roll out the ChatGPT Enterprise license to its 75,000 U.S. employees and 26,000 U.K. employees.

PwC has also developed an internal chatbot, ChatPwC, based on OpenAI’s GPT-4 model. The ChatPwC tool has seen a 20% to 40% increase in productivity among employees.

Deloitte

Deloitte is also taking steps to establish AI as a key part of its audit services. For example, their Digital Audit Technology, Deloitte Omnia, has incorporated AI capabilities through an internal chatbot, DARTbot.

DARTbot is an application of generative AI to create a simplified helpdesk chatbot for audit and assurance professionals to use as a reference and assistant.

Examples from smaller firms

Smaller accounting firms also benefit from AI, particularly in automating bookkeeping and tax preparation tasks.

AI tools designed for small businesses can have the following applications:

- Streamlining data entry

- Simplifying tax compliance

- Automating invoicing

For example, Xero’s new GenAI-powered smart business companion, Just Ask Xero (JAX), enables small businesses to query any accounting-related matters using a conversational interface. Their customers will not be required to know any AI skills to gain deep insight into their financial data.

Generative AI in Accounting

Beyond just regular AI, generative AI has been put in the spotlight in recent years for its ability to create new and unique content.

Overview of generative AI

Generative AI is a type of AI that can create new content and ideas, such as text, images, videos, music, and audio. It works by learning from existing data and then generating new data with similar characteristics.

Generative AI is now being applied across various uses, with the most used application being AI chatbots for internal reference.

For example, Deloitte has launched a ‘DARTbot’ internal chatbot to assist audit and assurance professionals to quickly research complex accounting questions

These capabilities allow accounting teams to handle large volumes of routine tasks, increasing their capacity to focus on strategic functions and advising.

Impact on accounting professionals

With generative AI handling repetitive research and reporting, accounting professionals can dedicate more time to strategic and analytical roles.

This shift allows accountants to better support business objectives, contribute insights, and engage in forward-looking planning rather than routine transactional work.

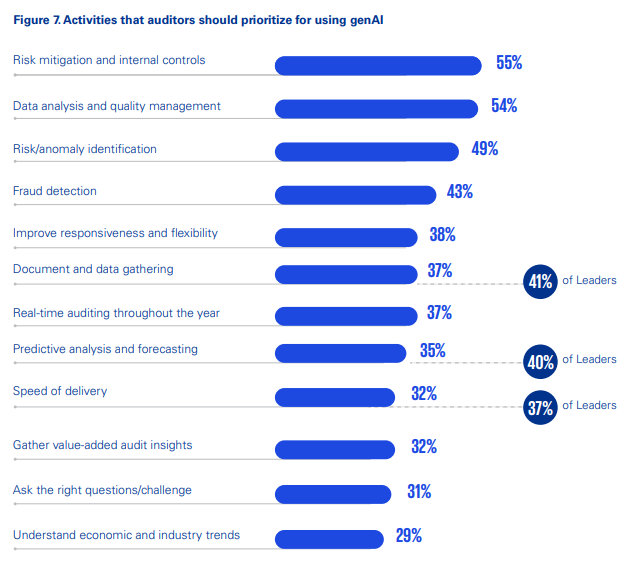

In a report by KPMG, most survey respondents felt that auditors should prioritize using GenAI for risk mitigation and internal controls, and data analysis and quality management, among others.

Challenges and Ethical Considerations

Having AI in your organization is highly beneficial but ensuring that it is implemented correctly comes with some challenges.

Here are some to take into consideration:

1. Data training and AI fluency

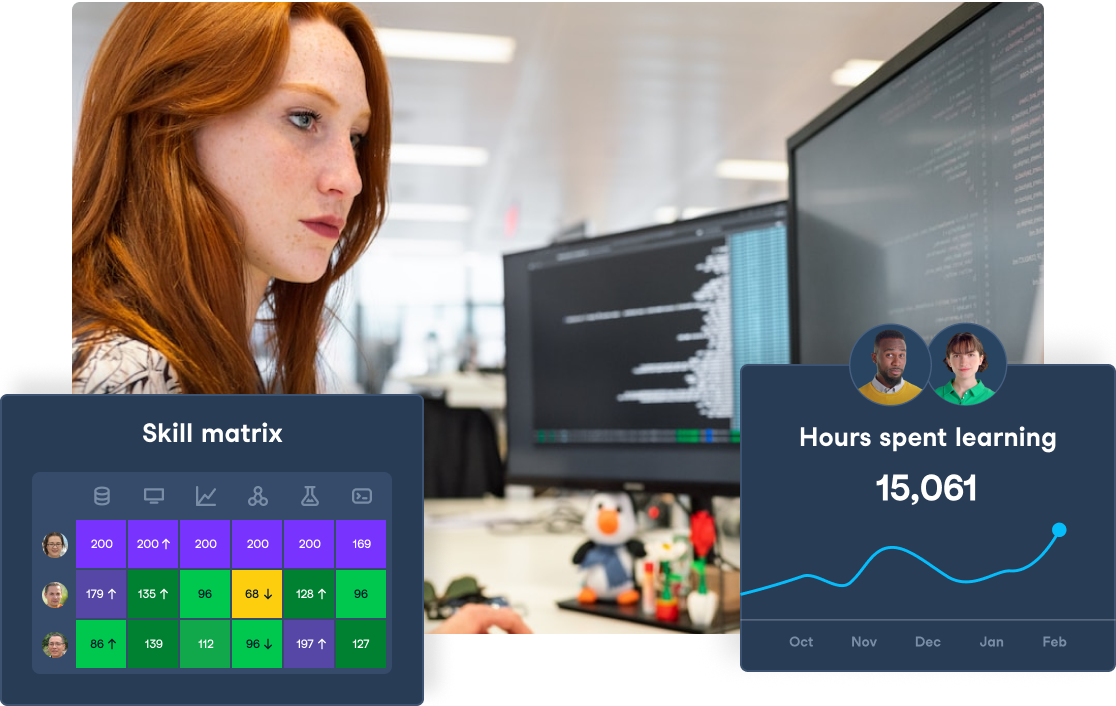

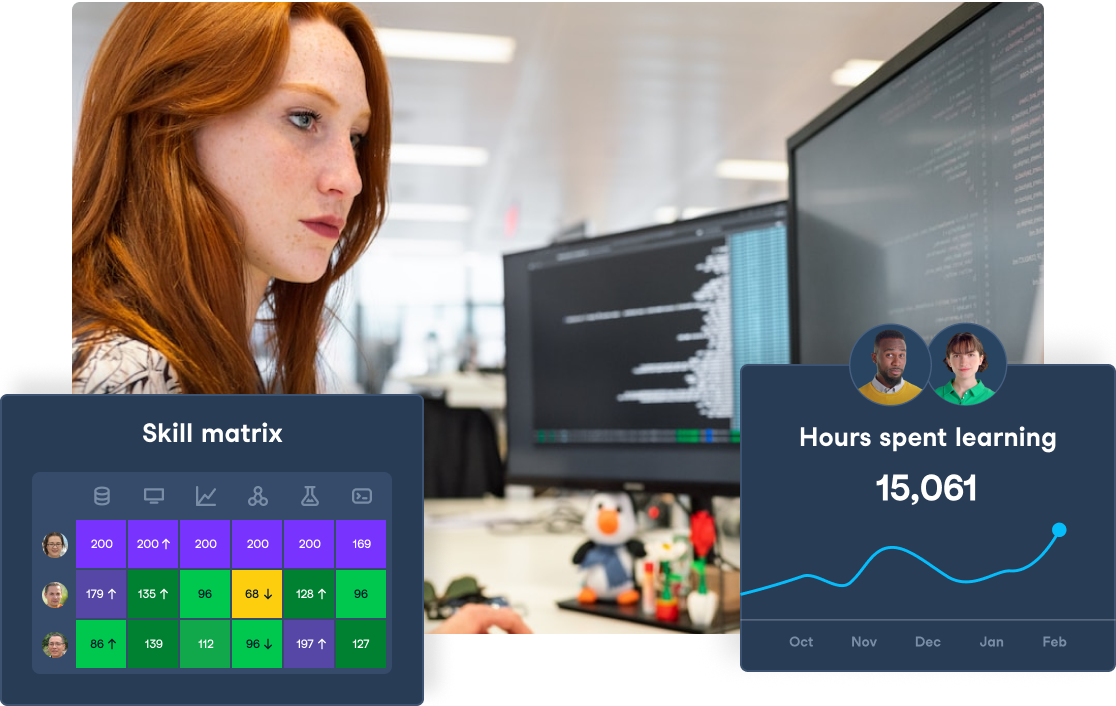

For accounting teams to leverage AI effectively, they require training in data management and AI tools.

This is where DataCamp For Business comes in.

DataCamp For Business delivers enterprise-level solutions to equip your professionals with the skills they need to understand and utilize AI in accounting workflows. With scalable and customizable options, as well as bespoke reporting, your teams can get started with foundational courses like Introduction to ChatGPT and AI Fundamentals and work their way up to expert-level courses.

Make the most of AI technology today, get started here, or Request a Demo.

Elevate Your Finance Team's Data Skills

Train your finance team with DataCamp for Business. Comprehensive data and AI training resources and detailed performance insights to support your goals.

2. Data security and privacy concerns

Working with AI comes with the challenge of ensuring data security and privacy. Financial data is highly sensitive, and organizations must implement robust security measures to prevent breaches.

To tackle this challenge, accounting teams should work with IT departments to establish data protection protocols and monitor systems for potential security vulnerabilities.

3. Ethical considerations

AI’s growing role in accounting raises ethical questions as well.

Like most use cases of AI, there are issues that need to be addressed such as:

- Transparency

- Regulatory compliance

- Responsible use

For example, a study found that AI was found not completely effective in tax accounting, due to the possible tax implications that may give rise from incorrect information.

Organizations need to adopt AI responsibly, ensuring that its application aligns with AI regulatory standards and industry best practices.

Some regulatory standards to keep in mind are:

Wrapping Up

AI is reshaping the accounting profession, automating routine tasks, enhancing accuracy, and enabling real-time financial insights. With its potential to improve efficiency and reduce costs, AI offers significant benefits for accounting firms of all sizes.

However, to fully harness AI’s capabilities, firms must address challenges related to training, data security, and ethical use. If your organization is looking to explore areas for AI implementation and requires necessary training, get started with DataCamp for Business today.

AI in Accounting FAQs

How is AI used in accounting?

AI is used in accounting to automate manual tasks, analyze large amounts of data, and provide insights for decision-making.

Is AI going to replace accountants?

No, AI is not meant to replace accountants but rather help them in their work. It can automate repetitive tasks and provide insights for more informed decision-making.

What are the benefits of using AI in accounting?

Some benefits include increased efficiency, reduced human error, improved data analysis, and cost savings.

Are there any risks associated with using AI in accounting?

Yes, some potential risks include privacy concerns, bias in algorithms, and job displacement for certain roles within accounting.

How can companies implement AI into their accounting processes?

Companies can start by identifying areas where AI could be beneficial and then implementing a plan to train employees on essential AI skills. Alternatively, they can also have a team of external experts create an AI solution.

I'm Austin, a blogger and tech writer with years of experience both as a data scientist and a data analyst in healthcare. Starting my tech journey with a background in biology, I now help others make the same transition through my tech blog. My passion for technology has led me to my writing contributions to dozens of SaaS companies, inspiring others and sharing my experiences.