Course

A financial analyst plays a vital role in the finance industry, offering insights into investment opportunities, economic performance, and risk management. This career is in high demand due to its significant impact on decision-making processes within organizations and investment firms.

With the increasing reliance on data-driven strategies, strong data analysis skills have become essential for financial analysts.

In this article, I will provide an overview of the financial analyst role, outline the steps to enter the field, and offer a structured roadmap to guide your career development.

What Does a Financial Analyst Do?

A financial analyst is responsible for evaluating financial data to support investment decisions and business strategies. Their primary duties include analyzing financial statements, forecasting financial trends, and assessing investment opportunities. They prepare reports and presentations that help stakeholders understand financial performance and make informed decisions.

There are several types of financial analysts, each specializing in different areas.

- Investment analysts focus on evaluating stocks, bonds, and other investment opportunities.

- Risk analysts assess potential financial risks and develop strategies to mitigate them.

- Portfolio managers oversee investment portfolios to maximize returns and manage risk.

- Equity research analysts provide insights and recommendations on individual stocks or sectors.

Financial analysts work across various industries, including finance, investment banking, corporate finance, and consulting, adapting their expertise to different organizational needs.

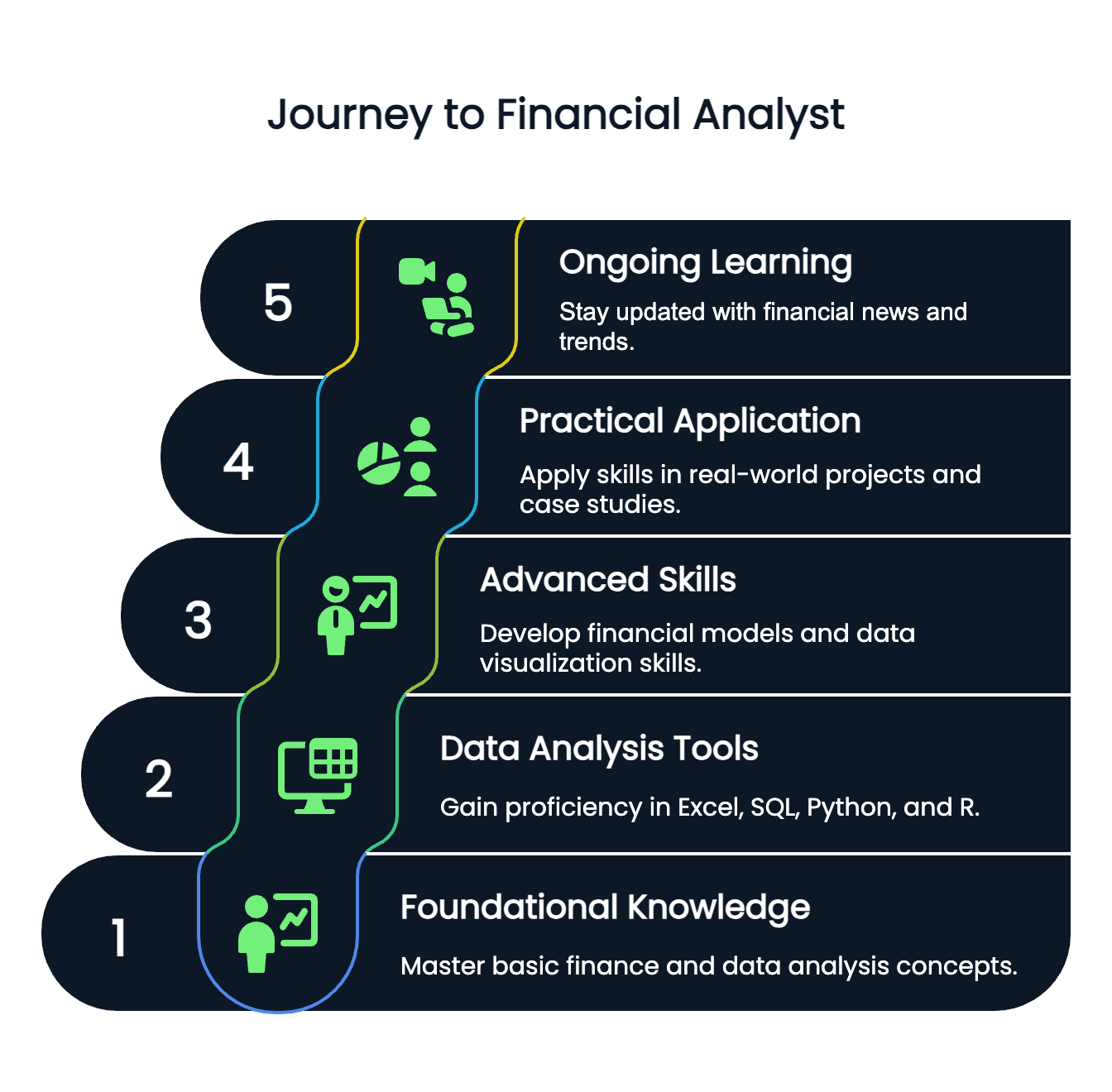

Roadmap to Becoming a Financial Analyst

To navigate the path to becoming a financial analyst, it’s helpful to follow a structured roadmap that covers foundational knowledge, tool proficiency, and practical application.

Here’s the structure I would follow.

Foundation

Begin by mastering the basics of finance, including understanding financial statements (income statements, balance sheets, and cash flow statements), performing cash flow analysis, and grasping basic accounting principles. Concepts like time value of money, interest, and budgeting are also important skills to learn.

This foundational knowledge is crucial for effective financial analysis. DataCamp covers many of these core concepts in the Introduction to Financial Concepts in Python course.

Then, learn the fundamentals of data analysis, such as descriptive statistics, data cleaning, and exploratory data analysis. These skills will help you interpret financial data accurately and derive meaningful insights.

These foundational topics are covered in the Exploratory Data Analysis in Python, or in the more targeted Importing and Managing Financial Data in Python courses.

Phase 1: Learning data analysis tools

Gain proficiency in Excel, focusing on financial functions, pivot tables, Data Analysis Toolpak, and financial modeling. Excel remains a vital tool for performing detailed financial analyses and creating robust financial models. You can learn these skills in the Financial Analytics in Google Sheets course.

Learn SQL to extract and manipulate financial data from databases. Practice writing queries, performing joins, and aggregating data to efficiently handle large datasets. DataCamp offers many courses in the SQL fundamentals track.

Start learning Python or R for advanced data analysis. Focus on libraries such as pandas and NumPy (Python) or dplyr and ggplot2 (R) for data manipulation and visualization, enhancing your ability to analyze complex financial data. DataCamp offers both Introduction to Python for Finance and Intermediate Python for Finance courses as well as Intro to R and Intermediate R for Finance courses.

Phase 2: Advanced data analysis skills

Develop and refine financial models using Excel and other tools. Learn to create comprehensive income statements, balance sheets, and cash flow statements, and perform scenario analysis to evaluate different financial scenarios. These skills, as well as advanced Excel functions skills, can be learned in the Financial Modeling in Excel course.

Learning about machine learning for finance and forecasting can also be a great way to stand out as a strong employee for financial modeling tasks.

Then, master data visualization tools like Tableau, Power BI, or Python’s matplotlib and seaborn libraries. Effective data visualization will help you create insightful dashboards and communicate your findings clearly. Much of these dashboarding and visualization tasks are covered in DataCamp’s Financial Analysis in Power BI course.

Phase 3: Practical application

Engage in real-world projects or case studies that involve analyzing financial data, building financial models, and making investment recommendations. Practical projects will help you apply your skills and gain valuable experience.

DataCamp offers a track tailored towards applied finance in Python, perfect for real-world project guidance. We also offer an Applied Finance in R track if R is your preferred language.

Also, consider undertaking a comprehensive capstone project that integrates all the skills learned. This could involve analyzing a company’s financial health, valuing a stock, or creating a detailed financial forecast, showcasing your expertise and analytical capabilities.

Ongoing learning

Continuously monitor financial news, market trends, and economic data to stay informed and relevant. Keeping up with the latest developments will enhance your ability to make informed financial decisions.

Join finance and data analysis communities, attend webinars, and participate in workshops. Networking with professionals and learning from peers will help you stay updated and provide opportunities for career growth and collaboration.

The journey to becoming a financial analyst. Image by Author.

How to Become a Financial Analyst with No Experience

Starting a career as a financial analyst without direct experience can be challenging, but it is entirely achievable by leveraging transferable skills and strategic learning. Even if you lack specific financial experience, you can still build a strong foundation for this role.

- Focus on transferable skills: If you don't have direct financial experience, highlight skills that are relevant to financial analysis. Analytical abilities, problem-solving, communication, and attention to detail are crucial in this field. Demonstrate how these skills have been applied in other contexts, such as academic projects or previous jobs, to show your potential as a financial analyst.

- Take online courses and certifications: To bridge the experience gap, consider enrolling in online courses and certifications. Platforms like DataCamp offer courses in financial analysis, Excel for finance, and data visualization that can provide you with essential knowledge and skills. These certifications and courses will bolster your resume and demonstrate your commitment to the field.

- Build a strong resume and LinkedIn profile: Craft a resume and LinkedIn profile that highlights any relevant coursework, skills, and experiences, even if they are not directly related to finance. Include personal projects, such as financial analyses or data-driven case studies, to showcase your analytical capabilities. Tailor your profiles to emphasize your skills and any relevant accomplishments to attract potential employers.

How to Become a Certified Financial Analyst

Earning certification can enhance your qualifications and career prospects as a financial analyst. Various certifications are recognized and respected in the industry, each offering unique benefits.

- CFA (Chartered Financial Analyst) certification: The CFA certification is one of the most esteemed credentials in the finance industry. It signifies a high level of expertise in financial analysis, portfolio management, and ethical standards. Achieving this certification involves passing three levels of exams and meeting work experience requirements, which demonstrates a strong commitment to the profession.

- Other relevant certifications: In addition to the CFA, other certifications can further enhance your qualifications. The Financial Risk Manager (FRM) certification is valuable for those focusing on risk management. The Certified Public Accountant (CPA) designation is beneficial for those interested in accounting aspects of finance. The Certified Financial Planner (CFP) certification is ideal for those looking to specialize in financial planning and advising.

- Study tips for certification exams: Preparing for certification exams requires a structured approach. Set up a study schedule that allocates regular time for review and practice. Utilize prep courses, study groups, and practice exams to familiarize yourself with the exam format and content. Consistent study habits and targeted preparation will increase your chances of passing the exams and achieving certification.

How Long Does It Take to Become a Financial Analyst?

The timeline to become a financial analyst varies based on your background, education, and career goals. Understanding the general timeline can help you plan your career path effectively.

- Generally, it takes about four years to earn a relevant bachelor’s degree in finance, economics, or a related field.

- Gaining practical experience through internships or entry-level positions may take an additional year or two.

- Obtaining certifications like the CFA can extend the timeline but adds significant value.

- Overall, expect to spend around 3-6 years from starting your education to becoming a fully qualified financial analyst.

To expedite your career path, consider pursuing internships or part-time positions while still in school to gain hands-on experience. Enroll in accelerated certification programs and leverage networking opportunities to connect with industry professionals and discover job openings. Proactively seeking out opportunities can help you advance more quickly in the field.

Tips for Success as a Financial Analyst

To excel as a financial analyst, it’s important to focus on both technical skills and professional development. Here are some key strategies for success in this field.

- Continuing education: The finance industry is constantly evolving, so ongoing education is crucial. Stay updated with industry trends, market conditions, and financial regulations through seminars, workshops, and industry conferences. This will help you remain knowledgeable and adaptable to changes in the financial landscape. Data analytics focused webinars are also a great way to continue education by listening to current thought leaders discuss financial concepts in the context of data analytics.

- Networking and building relationships: Networking is a valuable aspect of career growth in finance. Join professional organizations, attend industry events, and build relationships with mentors and peers. Networking can provide insights, career opportunities, and professional support that are vital for career advancement.

- Developing soft skills: In addition to technical expertise, soft skills such as communication, teamwork, and presentation skills are essential. These skills help you effectively convey complex financial data to clients and stakeholders, collaborate with colleagues, and present your analyses clearly.

Conclusion

Becoming a financial analyst involves a combination of educational qualifications, practical experience, and continuous learning. By focusing on transferable skills, obtaining relevant certifications, and following a structured career path, you can successfully enter and excel in a financial analyst career.

For further reading and resources, check out the courses linked throughout each section of this article as well as our Finance Fundamentals in Python learning track!

Financial Modeling in Excel

FAQs

What industries hire financial analysts the most?

Financial analysts are in demand in investment banking, asset management, corporate finance, consulting, and tech companies with large financial operations.

How much does a financial analyst earn on average?

Entry-level analysts typically earn between $60,000–$80,000 annually in the U.S., with experienced professionals and those in high finance roles earning six figures.

Do I need a degree to become a financial analyst?

While a finance-related degree is helpful, strong data skills and certifications can also open doors—especially if paired with projects or portfolio work.

What programming languages are most useful for financial analysts?

Python and R are top choices for data analysis, while SQL is essential for database queries. Excel remains a staple for modeling and reporting.

Can I become a financial analyst through self-study?

Yes, many successful analysts are self-taught through online courses, certifications, and real-world projects. Demonstrating skill is often more important than formal education.

How important is networking in the financial analyst field?

Extremely important. Networking can uncover hidden job opportunities, connect you with mentors, and provide industry insights not found in coursework.

What soft skills should a financial analyst have?

Communication, critical thinking, attention to detail, and presentation skills are key for explaining insights and influencing business decisions.

What kind of projects can I include in a financial analyst portfolio?

Stock analysis, company valuations, financial dashboards, forecasting models, and scenario simulations all showcase relevant skills.

How do financial analysts use machine learning?

They apply ML models for stock price predictions, fraud detection, risk analysis, and automating repetitive data analysis tasks.

Data Science writer | Senior Technical Marketing Analyst at Wayfair | MSE in Data Science at University of Pennsylvania